The Startup Founder’s Guide to Venture Debt: Terms, Timing & Risks

Learn about a financing option gaining momentum in the last decade (and no, it's not venture capital!). Discover why venture debt could be a viable alternative for funding your business.

Why Founders Shouldn’t Ignore Venture Debt in 2025

If you're a founder raising capital, odds are you’ve heard a lot about venture capital — and not enough about venture debt. But this quiet financing tool has gone from niche to mainstream, especially in the last decade, and it’s now a serious alternative for startups. Venture debt is a non-dilutive way for startups to raise capital without giving up equity. It helps extend runway, fund growth, and preserve ownership—if used strategically.

Unlike equity financing, venture debt doesn’t dilute your ownership or force you to take on a new investor. Instead, it’s a loan structure tailored for VC-backed startups with traction, backed by banks and specialized lenders who understand the high-growth game.

But here’s the catch: many founders treat venture debt like a shortcut. The wrong timing, the wrong lender, or even the wrong clause in the term sheet can come back to bite — sometimes years later. That’s why understanding the mechanics before you sign is critical.

Brought to you by Pacaso - Top investors are buying this “unlisted” stock

When the team that grew Zillow from seed to IPO starts a new company, people notice.

No wonder SoftBank invested in Pacaso. Their platform sells fractions of premier properties, revamping a $1.3T market.

And it works, earning $110M+ in gross profits already. They even reserved the Nasdaq ticker PCSO. But no need to wait. Invest for $2.80/share by today:

TL;DR – Key Lessons on Venture Debt for Startups

Venture debt helps extend runway without giving up equity

Ideal after a recent VC round, not as a last resort

Understand terms: interest, warrants, covenants, and MAC clauses

Lenders care more about investors and milestones than profitability

Borrow strategically, not reactively

What Is Venture Debt and How Does It Work?

Venture debt is a type of non-dilutive startup financing that allows founders to raise capital without giving up equity. Instead of issuing new shares, startups borrow money—typically with a fixed interest rate and a small equity kicker in the form of warrants. It’s most commonly used by VC-backed startups with recent funding rounds, solid growth potential, and clear plans for reaching their next milestone.

Unlike traditional bank loans, venture debt is designed for high-growth, cash-burning startups. Lenders aren’t looking for profitability—they’re betting on your ability to raise future equity or reach break-even. That’s why the most common providers of venture debt include:

▫️ Venture banks: e.g., SVB (now First Citizens), HSBC Innovation Banking, Bridge Bank

▫️ Specialty lenders: e.g., Hercules Capital, TriplePoint, Runway Growth Capital

▫️ Venture debt funds: e.g., InnoVen, Stride Ventures, Alteria Capital, Columbia Lake

Startups use venture debt to:

▫️ Extend runway without dilution

▫️ Bridge to a larger round or exit

▫️ Fund growth initiatives (GTM, product, expansion)

▫️ Finance equipment or capex without new equity

In short, venture debt gives you cash now, control later. It’s not free money—repayment is required—but for the right startup at the right moment, it can be a powerful growth lever.

Table of Contents

Why Venture Debt > Venture Capital?

What Do Venture Debt Lenders Look For in Startups?

What Are the Terms and Structures of a Venture Debt Deal?

How Does Venture Debt Impact My Cap Table and Control of the Company?

When Is the Right Time to Acquire Venture Debt?

How Can I Mitigate the Risks of Venture Debt?

Venture Debt Might Be Your Quiet Advantage

1. Why Venture Debt > Venture Capital?

Venture debt is a unique type of financing offered to startups that have already raised equity from institutional investors. It’s often used to extend runway, finance growth, or cover one-off expenses without triggering a new equity round. Instead of selling shares, you’re borrowing capital that gets repaid over time, usually with interest and a small equity kicker in the form of warrants.

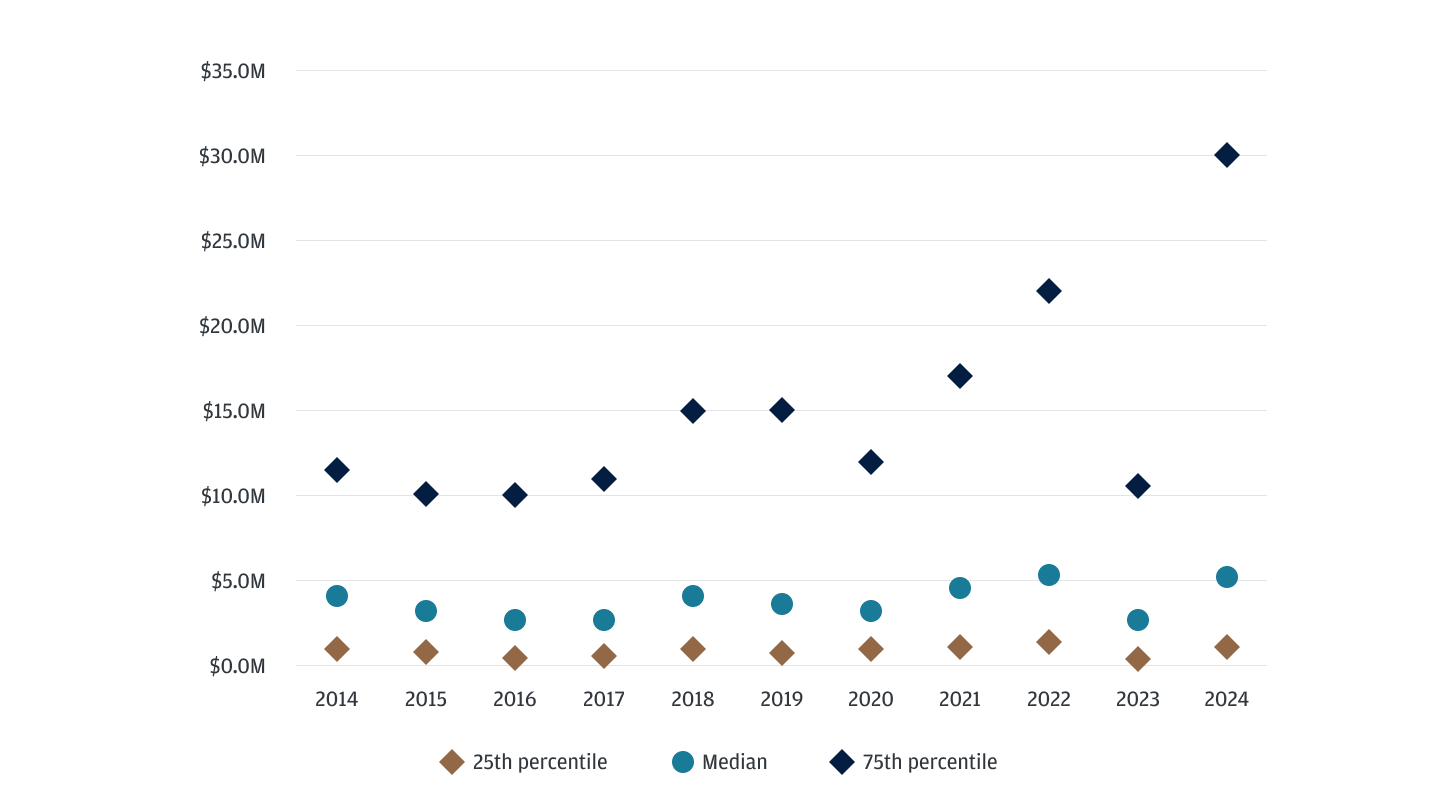

For founders who want to preserve ownership and avoid unnecessary dilution, venture debt can be a strong alternative. It lets you grow on your terms while keeping more of the upside. Venture debt has gained momentum in the last decade, with an increase in activity and deal sizes.

Venture Debt Deal Sizes in the Last 10 Years

2. What Do Venture Debt Lenders Look For in Startups?

Venture debt is offered by a range of lenders, such as venture banks, business development companies (BDCs), and specialized debt funds. Some of the notable names in the space include Silicon Valley Bank (rebranded as First Citizens Bank in the U.S. and HSBC Innovation Banking in the UK and parts of Europe), Hercules Capital, TriplePoint (TPVG), and Bridge Bank. Globally, funds like Alteria Capital, InnoVen, Stride Ventures, and Lighthouse Canton also back startups with non-dilutive growth capital. These lenders typically work with VC-backed startups that have traction and clear near-term milestones.

So what are they looking for in a borrower? It’s not about profitability or hard assets. Lenders care more about your investor backing, runway, burn rate, and your ability to raise future equity. In most cases, they expect repayment to come from either your cash flows or your next fundraise.

Founders should be ready to show:

A recent or ongoing venture round with credible investors.

Lenders prioritize businesses that are already backed by reputable firms. Having prior investor support is a green flag for these institutions, indicating the company has additional resources and is carefully managing its finances.

At least 12 months of operational runway (even before the loan).

These banks and lenders want to see that your startup won’t be solely relying on the loan you’re seeking to make ends meet. It’s more credible to have at least a year’s worth of runway to demonstrate the vitality of your business, giving lenders confidence in your repayment capabilities.

A plan for using the capital to drive growth or hit key milestones.

Having a plan shows lenders how you plan on putting that new capital to work. Whether you’re plan is to scale GTM efforts, expand your team, or invest in product development, a plan helps justify the risk when applying for venture debt.

A likely path to a follow-on round or sustainable cash flow.

Along with a plan, you’ll want to be able to map the path forward to your lender. Since repayment is expected to come from future funding or increased cash flow, you’ll want to paint a nice picture, whether that looks like another round or profitability.

Clean financials and basic reporting systems in place.

The best deals are done with solid accounting. Keeping a basic reporting system and having the financial data to back it up will assure lenders that your company’s performance is being monitored throughout the term of the loan.

Lenders may also ask for other key indicators such as banking exclusivity, basic covenants, and warrants. The stronger your metrics, the more leverage you’ll have in negotiating the terms.

3. What Are the Terms and Structures of a Venture Debt Deal?

Venture debt deals come with a standard set of moving parts. While the headline number might look simple, the details in the term sheet can shape how founder-friendly-or or founder-punishing the deal turns out to be.

Here are the core components of a venture debt loan to understand before signing:

Loan Amount and Draw Period

Lenders usually offer 20% to 40% of your last equity round. You may not get it all upfront. Many deals have a draw period, which is a window (often 6–12 months) when you can tap into the loan in tranches, based on milestones or timing.

Interest Rate and Term

Expect a floating interest rate, often based on the prime rate plus a margin. As of now, that typically puts effective interest in the 9–14% range. Terms usually run from 3 to 4 years.

Interest-Only Period

Many lenders offer an interest-only period at the start, typically 6 to 18 months. You pay only the interest during this time. After that, the loan amortizes, meaning you pay down both principal and interest monthly.

Warrants

Warrants are a lender’s equity kicker. It gives them the right to buy a small number of shares at a set price. Warrant coverage is typically 0.5% to 2% of company equity, depending on deal size, lender appetite, and negotiation. This is how lenders participate in your upside.

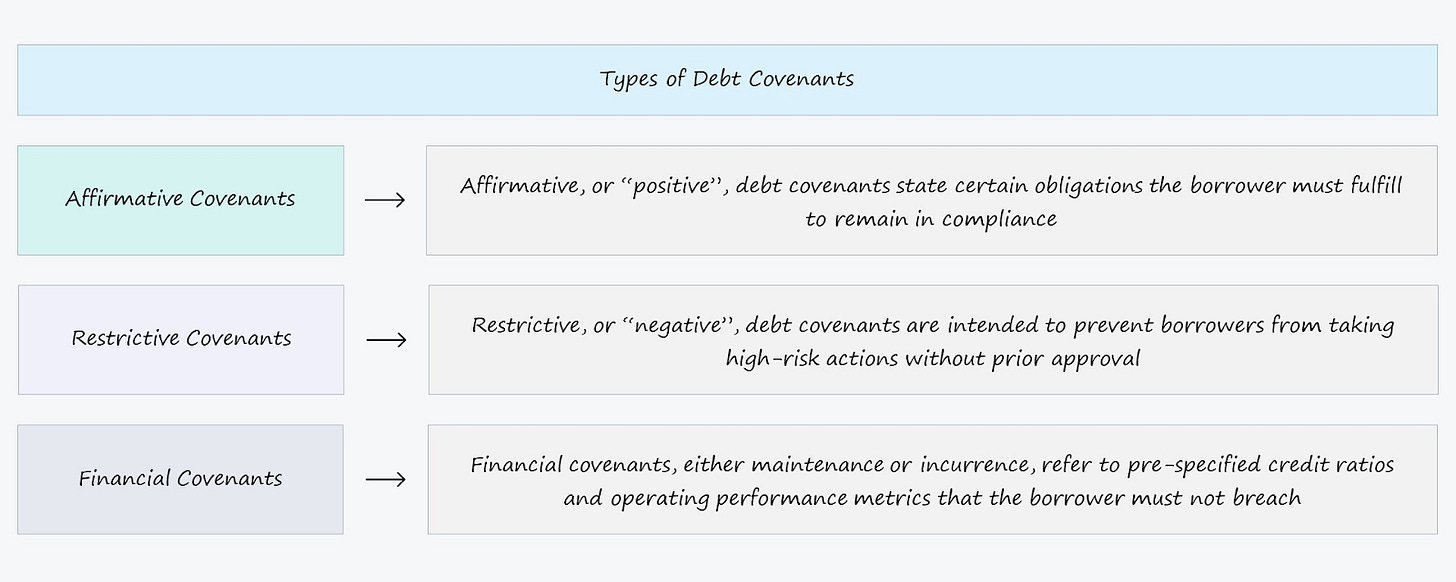

Covenants

Most early-stage venture debt is light on covenants, but not always. Some lenders will include financial or operating requirements like minimum cash balances, revenue thresholds, or even VC participation in future rounds. Breaching these could trigger default, so always read the fine print.

Collateral and Security

Venture debt is often secured by a blanket lien on your company’s assets, sometimes including intellectual property. Lenders want to know they’re first in line if things go sideways.

Fees

Upfront fees, backend fees, and legal costs are all common. Expect a few percentage points in fees baked into the cost of capital. Always model this out when evaluating offers.

MAC Clauses and Triggers

Many deals include Material Adverse Change (MAC) clauses, giving lenders the right to call the loan if your business deteriorates significantly. Some agreements also include “investor support” clauses that require existing VCs to keep backing you.

Understanding these terms helps you negotiate better, avoid hidden traps, and choose the right structure for your stage and goals. Not all debt is created equal. What’s in the term sheet matters just as much as the check size.

4. How Does Venture Debt Impact My Cap Table and Control of the Company?

Venture debt’s biggest appeal is that it lets you raise capital without giving up a large piece of your company. You keep your equity, your voting rights, and your board control. That makes it a powerful tool for founders who want to scale without taking on unnecessary dilution.

Unlike a priced equity round, venture debt doesn’t require you to issue new shares to the lender, just warrants. These are options to buy a small amount of stock, typically equal to 0.5% to 2% of total equity, depending on the size of the loan and lender appetite.

The impact on your cap table is minimal compared to an equity round, especially in the early stages. For example, giving up 20% in a Series A versus 1% through a debt deal with warrants puts you in a much stronger position long-term. That matters when you’re stacking multiple rounds over several years.

Venture debt helps you avoid dilution, without slowing down your growth. It’s not free capital, but if you’re confident in your trajectory and want to stay in the driver’s seat, it can still be a smart addition to your funding strategy.

5. When Is the Right Time to Acquire Venture Debt?

Timing matters. The best way to use venture debt is proactively, and not as a last resort. The sweet spot is right after you’ve raised equity and still have momentum, not when you're scrambling for cash.

Here are some smart moments and milestones to consider when acquiring venture debt:

Post-Equity Round, With Momentum

You've just closed a Series A or B with strong investors. You’re not burning cash too fast, but you want extra runway to hit bigger milestones. Venture debt can help you avoid raising your next round too early or at a lower valuation.

Expanding Into New Markets or Products

You’ve proven product-market fit and want to expand your GTM team or enter new verticals. Instead of diluting equity, you can use venture debt to fund this sprint while preserving your cap table.

Equipment, Inventory, or One-Off Capex

If your business has a specific need - hardware purchases, manufacturing, or infrastructure buildout - venture debt can help finance it without touching your equity pool.

Bridging to Profitability or the Next Raise

You’re approaching profitability or planning a large Series C in 12 months. Venture debt can be a bridge, giving you breathing room to grow into better metrics before you raise again.

Defensive Liquidity

Markets are shaky, and you're sitting on decent runway but want an insurance policy. Raising venture debt early (while your fundamentals look strong) can give you optionality without panic fundraising.

The right time is when you don’t desperately need it but know how to deploy it. The best deals happen when you’re in control of the timing, not reacting to pressure.

6. How Can I Mitigate the Risks of Venture Debt?

Venture debt is a useful tool. However, it comes with fixed obligations, lender controls, and downside exposure if things go sideways. The key is to manage that risk up front, not after the loan is signed.

To protect your startup, start by not overborrowing and stress-testing your repayment plan. Just because you’re offered $5M doesn’t mean you should take it all. A good rule of thumb is to raise 20–40% of your last equity round. Too much leverage can limit your options later, especially in a down market. Model multiple growth scenarios. Ask yourself - Can we still make payments if revenue stalls? What happens if the next round is delayed by six months? Don’t assume perfect execution.

Make sure to properly negotiate founder-friendly terms. Focus on minimizing restrictive covenants and reducing warrant coverage. Look out for vague clauses (remember material adverse change?), which could give lenders broad rights to pull funding. Push for clarity on all triggers.

Next, make sure to choose the right lender and align with your board/investors. Lenders are neither equal nor are all right for you. Work with those who have a track record of supporting startups, even when things get bumpy. Ask other founders how the lender behaved when performance dipped. Surprise debt moves can create friction. Get buy-in early, and make sure your investors are aligned on how the capital will be used. Many lenders will ask for continued investor support as a condition anyway.

And finally, use the capital strategically. Treat venture debt as a growth lever, not a safety net. Deploy it toward projects with clear ROI - customer acquisition, product expansion, or market entry. Avoid using it just to extend runway for the sake of survival.

Managing venture debt is about discipline, not fear. With the right safeguards and a repayment plan, it can amplify growth without putting your company at risk.

7. Venture Debt Might Be Your Quiet Advantage

Venture debt isn’t a silver bullet, but in the right hands, it’s a sharp tool. The founders who benefit most are the ones who treat it like a strategic lever, not a lifeline. They borrow with a clear plan, align with their investors, and negotiate terms that protect their future.

If you’re scaling fast, sitting on fresh equity, or gearing up for a big milestone, venture debt might be your quiet advantage. Remember that the smartest capital isn't always the flashiest. It’s the capital that lets you keep building while keeping more of what you’ve built.

Venture Debt FAQ: What Founders Are Asking in 2025

What is venture debt and how is it different from venture capital?

Venture debt is a non-dilutive form of startup financing that provides loans—typically with interest and small warrant coverage—without requiring equity ownership. Unlike venture capital, which buys shares in your company, venture debt lets you preserve your cap table while accessing growth capital.

When should a startup consider venture debt?

The best time to raise venture debt is right after a strong equity round, when you still have 12–18 months of runway. It works well for startups looking to extend runway, hit key milestones, or bridge to profitability or the next funding round—without immediate dilution.

What are the risks of venture debt for founders?

Venture debt comes with fixed repayment obligations and often includes covenants, collateral, and MAC clauses. If growth stalls or the next round is delayed, it can become a financial burden. Founders should stress-test repayment scenarios and negotiate founder-friendly terms.

Does venture debt affect my cap table?

Not significantly. Venture debt usually includes warrants—giving the lender the right to buy a small percentage (typically 0.5–2%) of equity—but it avoids large-scale dilution like equity rounds. This makes it appealing for founders looking to retain ownership and control.

Who are the top venture debt lenders for startups in 2025?

Leading global venture debt lenders in 2025 include:

▫️ First Citizens Bank (formerly SVB)

▫️ Hercules Capital

▫️ TriplePoint Venture Growth (TPVG)

▫️ InnoVen Capital

▫️ Alteria Capital

▫️ Stride Ventures

▫️ Bridge Bank / Western Alliance

Each lender varies in risk appetite, deal structure, and geography—so it’s essential to match your stage and needs with the right partner.

RESOURCES 🛠️

✅ How VCs Value Startups: The VC Method + Excel Template

✅ 300+ VCs That Accept Cold Pitches — No Warm Intro Needed

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ 144 Family Offices That Cut Pre-Seed Checks

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 89 Best Startup Essays by Top VCs and Founders (Paul Graham, Naval, Altman…)

✅ The Ultimate Startup Data Room Template (VC-Ready & Founder-Proven)

✅ The 100+ Pitch Decks That Raised Over $2B

✅ Ultimate Investor List of Lists (+5k VCs)

✅ 40 Pitch Decks That Raised Over $460M

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 400+ Seed VCs Backing Startups in the US & Europe

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox

Loved this 🖤