How VCs Value Startups: The VC Method + Excel Template

Learn the Venture Capital Method step-by-step with a Excel template that models valuation, dilution, and investor returns across funding rounds.

"Wondering how venture capitalists decide your startup’s valuation?" This guide breaks down the proven Venture Capital Method — and includes a Excel model to help you run your own numbers.

If you’re a founder raising capital, understanding how investors value your startup is one of the most underrated superpowers you can have.

Most founders know about pre-money, post-money, and dilution. But few truly understand how venture capitalists back into a valuation based on their return expectations — or how that math changes across multiple rounds.

Enter the VC Method: a fast, practical framework that investors have used since the ’80s to price deals. And today, we’re sharing a Excel template that helps you run the same analysis in minutes — with no fancy modeling skills required.

What Is the Venture Capital Valuation Method for Startups?

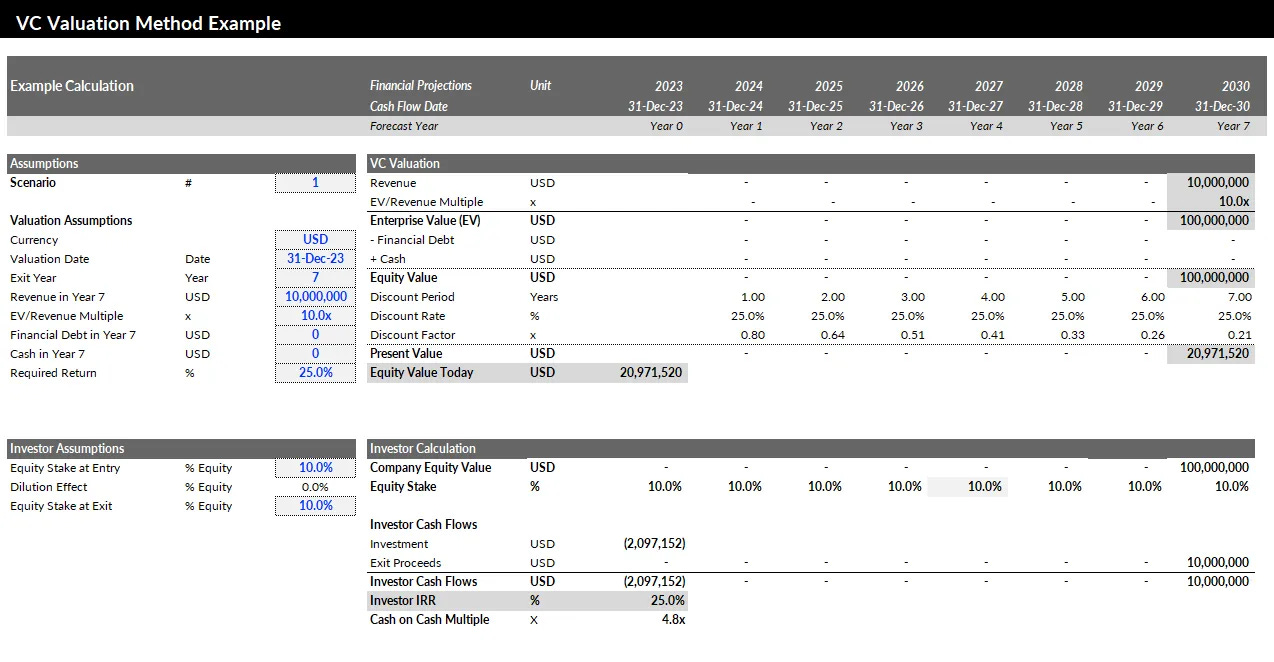

The Venture Capital Method is a startup valuation approach that works backward from a future exit.

Instead of trying to value a company based on cash flows (hard to do when you’re pre-revenue), the VC Method estimates what the company could be worth at exit (IPO or M&A), then discounts that number back to today using the investor’s target return.

It looks like this:

▫️ Forecast exit value (e.g. $100M based on comps or revenue x multiple)

▫️ Apply a required return (typically 25%–40%)

▫️ Discount back to today to get your valuation

▫️ Compare your check size to that valuation to determine your ownership stake

This method helps VCs answer one question: “If I invest $X today, will I get a 10x return if this company exits in Y years?”

Excel Template for Startup Valuation and Dilution Modeling

This isn’t just a basic calculator. It’s a multi-round, fully built VC Method modeling tool designed for both founders and investors.

✅ Key features:

Round-by-round inputs for Seed, Series A, B, C and beyond

Target revenue and multiple-based exit valuation

Fully modeled dilution by round

Equity stake evolution for founders, investors, and ESOP

IRR and cash-on-cash return calculations per investor

Dynamic scenario analysis: base, upside, downside

Visual ownership waterfall across time

It’s the clearest way to understand:

💸 How much equity you’re giving away

💥 What future returns investors expect

🧮 How multiple rounds affect your cap table and exit math

Why Founders Should Use the VC Method to Plan Startup Valuation

This model is designed for one purpose: long-term clarity.

Founders often negotiate valuation one round at a time — but capital planning is a multi-round game. If you raise $1M now and $5M next year, what’s the real cost of that capital when you exit?

This template helps you answer:

What’s a fair pre-money for this round — given investor return expectations?

How will dilution affect me across multiple rounds?

What does an exit at $200M actually look like for early investors vs. late?

Can I justify my valuation with actual numbers — not vibes?

Whether you’re preparing for investor conversations, negotiating term sheets, or planning internal cap table strategy, this model gives you a clear, defensible view of startup valuation over time.

📥 Want the VC Valuation Template?

The spreadsheet is fully editable and works in Excel. Just plug in your startup’s projected revenue, round sizes, expected dilution, and the rest is auto-calculated.

The VC Valuation Template is available exclusively to premium subscribers of The VC Corner.

It’s part of a growing library of resources designed to help startup founders raise capital, grow smarter, and move faster. As a member, you’ll get:

✅ Ultimate Investor List of Lists: +10k VCs, BAs, CVCs, and FOs

✅ 70+ Startup Pitch Decks That Raised Over $1B in 2024

✅ 50 Game-Changing AI Agent Startup Ideas for 2025

✅ The 100+ Pitch Decks That Raised Over $2B

✅ SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

✅ 118 AI Communication Agent Use Cases

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox 🛠️

✅ The Startup Founder’s Guide to Financial Modeling (7 templates included)

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

… and much more

If you’re serious about raising, this is the unfair advantage you’ve been looking for.

Download the VC Method Valuation Template below 👇

I hope you find it helpful :)

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.