The last few years have been a rollercoaster for venture capital. If 2020-2021 was the gold rush, then 2024 is the great reckoning. A flood of capital, sky-high valuations, and a now-frozen exit market have left the industry in crisis mode.

Brought to you by Vanta

Unlock a 526% ROI with Vanta, the GRC platform built for startups that simplifies security and compliance.

Download the IDC study to learn how Vanta helps fast-growing businesses save time, boost team productivity, and fuel growth. Streamline risk management, demonstrate trust to customers, and scale your startup—without the hefty costs and complexity.

A recent deep dive by carrynointerest lays out the data—and it’s not pretty. Let’s unpack what went wrong and where venture capital goes from here.

1. The Unicorn Frenzy: Too Much Capital, Too Few Great Companies

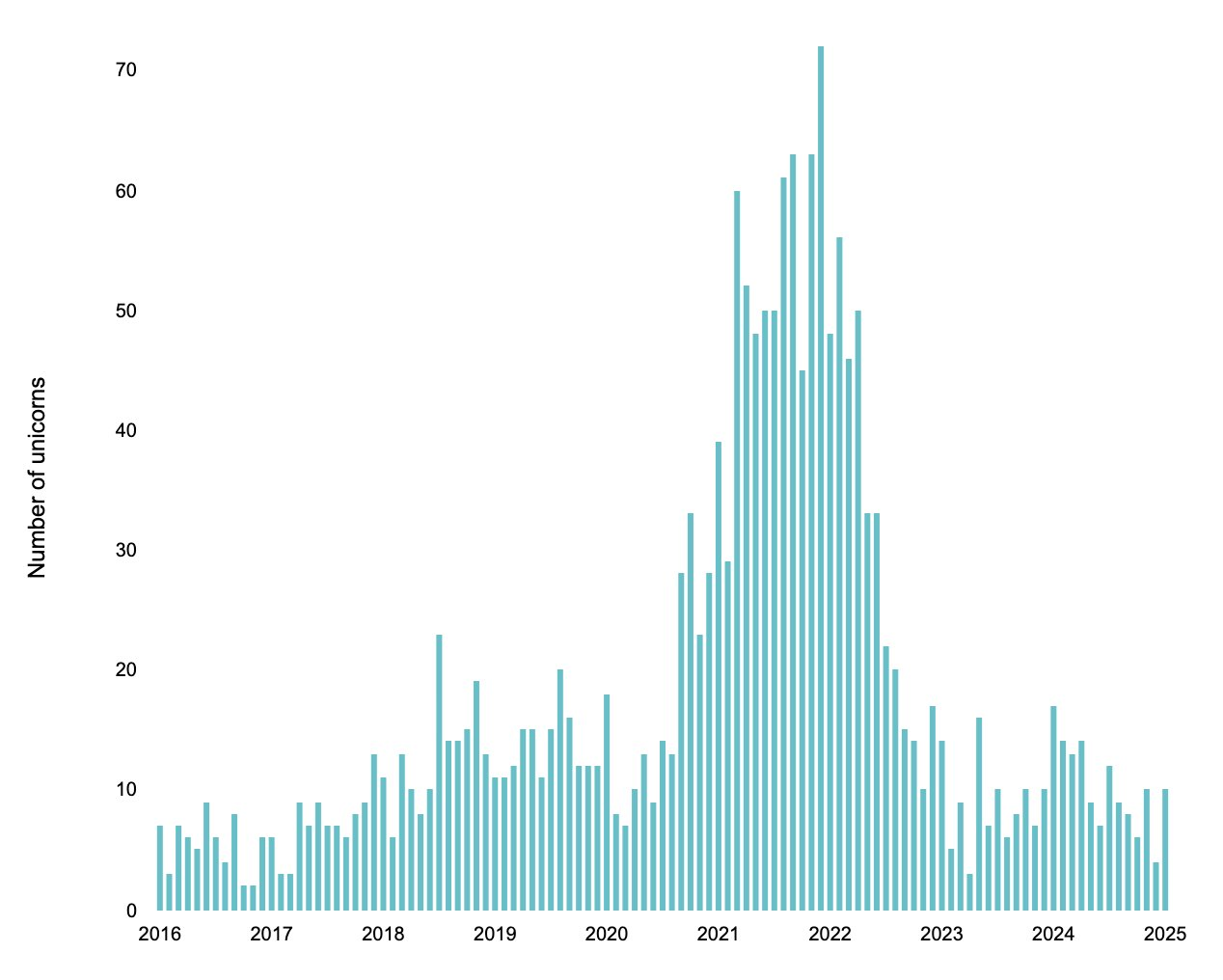

In 2020 and 2021, low interest rates and an abundance of LP capital created the perfect storm for venture. Startups were raising rounds at a dizzying pace, and investors were throwing money at anything that moved. The result? A record-setting number of unicorns.

In just two years, more unicorns were created than in the entire previous decade.

But the problem wasn’t just the quantity—it was the quality. The number of truly transformational startups didn’t increase. Capital just kept flowing, artificially inflating valuations and expectations.

2. The Interest Rate Sledgehammer That Crushed M&A

By 2022, everything changed. The Federal Reserve’s aggressive rate hikes meant easy money was gone. Startups that had raised capital expecting infinite runway suddenly had to grapple with reality: their next funding round might not come.

🔻 Without cheap capital, acquirers started disappearing. No IPOs, fewer buyouts, and a growing number of orphaned startups.

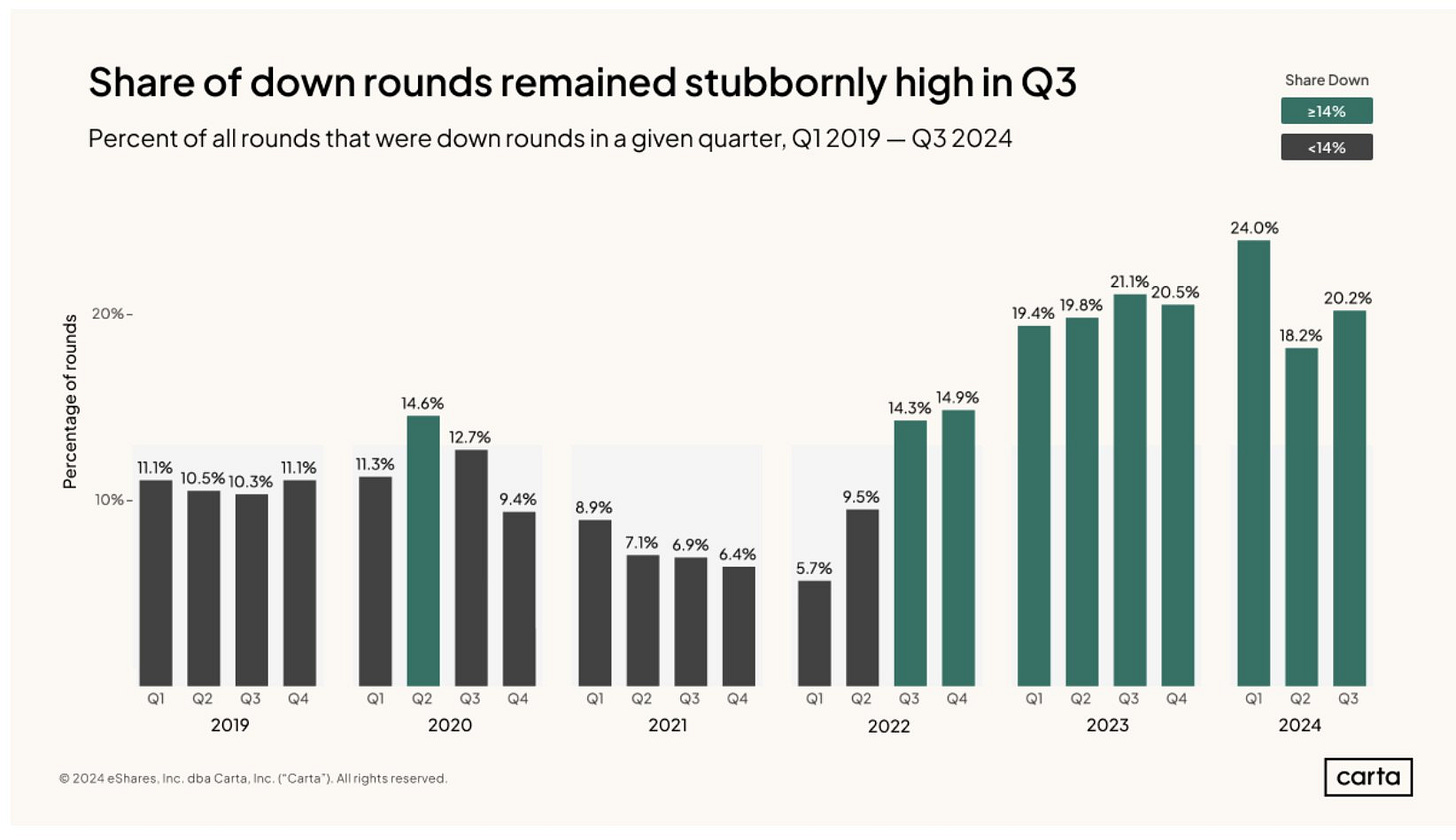

3. The Down Round Epidemic: When Reality Hits

As the market corrected, startups that had raised at peak valuations in 2021 found themselves in trouble. Growth slowed, revenue multiples shrank, and suddenly, the only way to stay afloat was raising at a lower valuation—something no founder wants to do.

📉 Nearly 1 in 5 funding rounds today is a down round. Some startups are seeing valuation cuts of 50% or more just to survive.

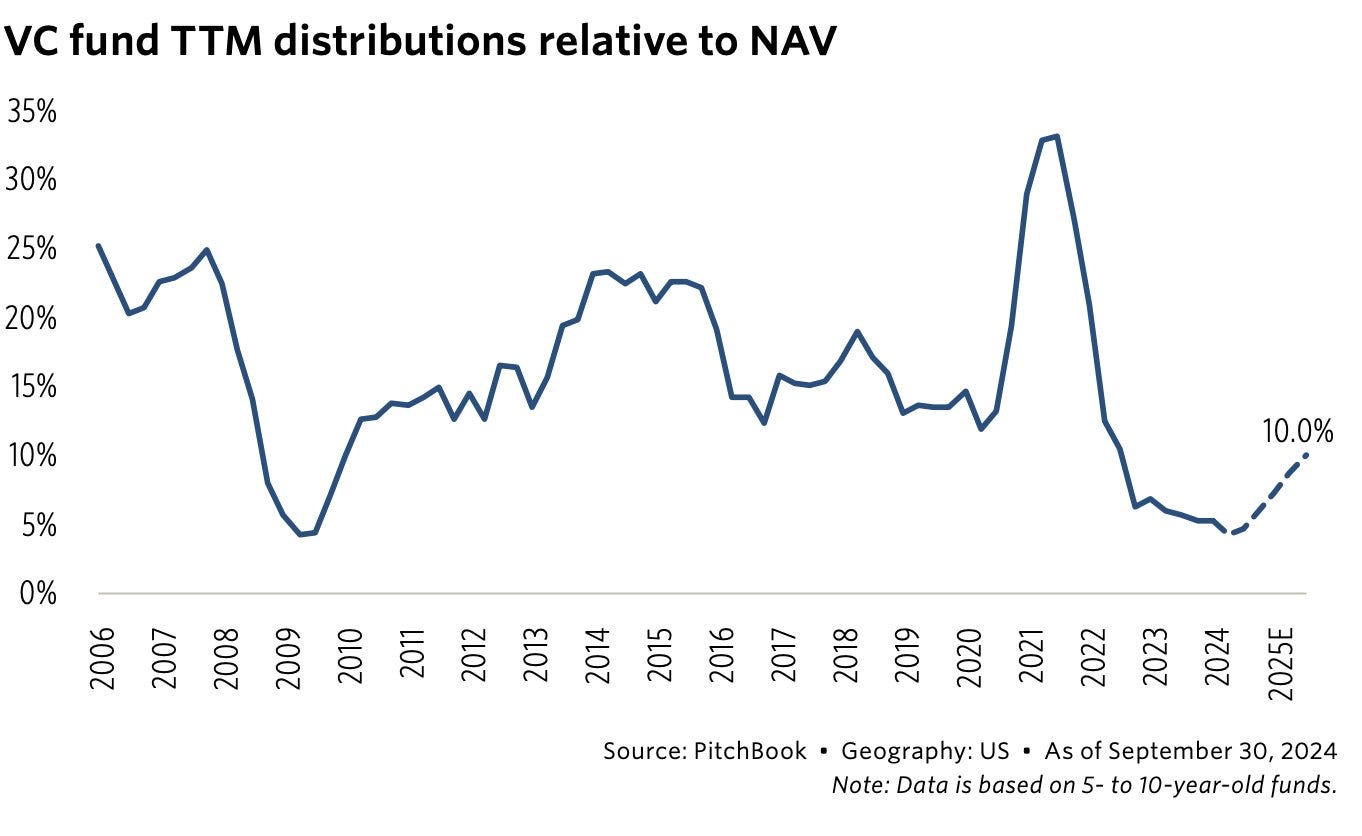

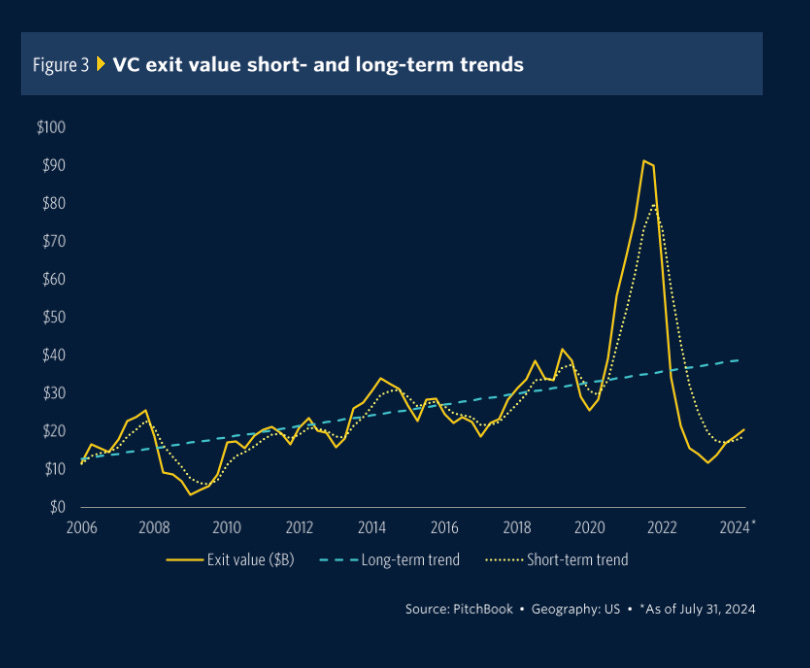

4. The Great Venture Capital Exit Problem

VCs rely on exits—whether through IPOs or M&A—to generate returns for LPs. For decades, exit values followed a predictable trend. But in 2021, the gap between expected and actual exits exploded.

🛑 No exits = no returns for LPs = less capital for new funds. This is the existential crisis facing many venture firms today.

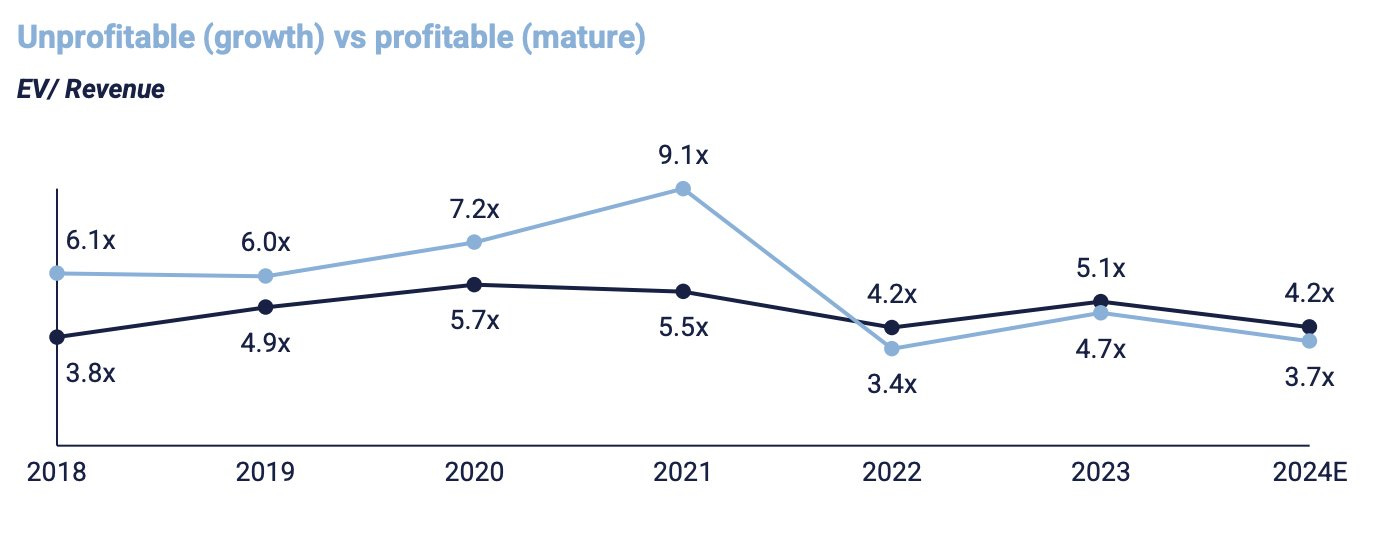

5. Valuations Have Collapsed

Once upon a time, high-growth startups commanded eye-watering revenue multiples. But that era is over. The Rule of 40 (revenue growth + profit margin) used to justify lofty valuations. Now? Investors are ruthless.

💸 A company valued at 9x revenue in 2021 might now fetch just 3-4x. That’s a painful reset for investors and founders alike.

Is Venture Capital Actually Dead?

While the current environment looks bleak, some counterpoints suggest this isn’t the end—just a painful correction.

Big VC Funds Still Have Support: LPs allocate to large firms for diversification and brand value. They aren’t abandoning venture.

A New IPO Pipeline Will Eventually Open: A handful of high-quality companies will go public, which could restore some liquidity.

Survivors Will Be Stronger: Weaker startups will die, but those that make it will be far more resilient and profitable.

The Future: A More Disciplined Market

Venture capital isn’t dying—it’s evolving. The reckless spending era is over. Now, investors and founders have to adapt:

Zombie Startups Are Everywhere: Companies that raised at sky-high valuations but can't justify them will struggle to survive.

VCs Must Prove They Can Deliver Returns: LPs are watching, and patience is running thin.

Founders Need to Be Smart: Profitability matters again. Growth-at-all-costs isn’t an option anymore.

The Bottom Line

The venture capital apocalypse isn’t a headline—it’s happening right now. The industry is being forced to reset, and only the strongest will make it through.

If you’re a founder or investor, now’s the time to rethink your strategy. The game has changed—make sure you’re playing by the new rules.

📩 Want to stay ahead of the market? Subscribe to The VC Corner for exclusive insights, data-driven analysis, and the best reporting on the future of venture capital.

Call me crazy but I think there are too many Venture funds now, so not only are startups competing and losing at an unimaginable rate, a lot of funds themselves are being outcompeted by larger funds. A lot of lobbying spent to keep up hype hides a lot of the details. My question is when the AI bubble bursts what happens to all of these funds that don't even have a great track record? I really do believe the costs will be high.

I raised $75 M in the late 90s only to watch our valuation collapse post 9/11. Not a dot com but we were drowned by that tsunami. Venture funding operates in cycles. Once this correction is over, things will return.