🌱 Seed Strapping: The Smarter Startup Funding Strategy Founders Are Turning To

A new trend in startup funding that could reduce founders’ dependency on venture capital

Picture this: Jane is a first-time founder with a big idea and a ton of passion. Like many entrepreneurs, she started her journey dreaming of VC-backed success — raising a seed round, pitching her Series A, and scaling to unicorn status. But after months of exhausting pitch meetings and term sheets demanding more equity than she wanted to give up, Jane hit a wall.

She started asking herself: Is venture capital the only way to grow a startup?

Turns out, it’s not…

Brought to you by Vanta for Startups - Unlock Effortless Compliance for Startups 🔐

Don’t let compliance be a blocker for growth.

Vanta’s solution automates up to 90% of the work for ISO 27001, SOC 2, and more, making it easier for startups to maintain continuous compliance and build trust with customers. Explore how Vanta’s platform can save you time and accelerate growth.

Jane discovered a new path: seed strapping — the strategy of raising just enough seed capital to get started, then building a sustainable, revenue-driven business without relying on follow-on funding. She used AI tools and no-code platforms to stay lean, focused on early monetization, and scaled step by step without giving up control.

Her company didn’t explode overnight — but it grew profitably, and she owned more of it.

Jane’s story isn’t unique. As startup funding becomes harder to secure in 2025, more founders are rethinking the traditional fundraising playbook. Seed strapping is quickly becoming a startup growth strategy that blends the best of bootstrapping and VC funding — and might just redefine the next decade of entrepreneurship.

Let’s explore how it works, why it’s growing fast, and whether seed strapping could be the right path for your startup too.

Table of Contents

The Fundraising Reality in 2025: Why Startups Are Looking for Alternatives

Seed Strapping: The “Goldilocks” Choice in Funding

The Myth That Startups Must Raise Multiple Rounds to Succeed

Why Seed Strapping is a Strong Alternative

The Hidden Burdens of Full VC Funding

Challenges of Seed Strapping: Is It the Right Fit for Every Startup?

How Investors View Seed-Strapped Startups: A Divided Perspective

The Hybrid Approach: Variations of Seed Strapping

The Future of the VC-Startup Ecosystem

Startup Growth Has Changed

🌍 The Fundraising Reality in 2025: Why Startups Are Searching for Alternatives

Startup fundraising has never been easy — but in 2025, it’s harder than ever.

U.S. startup funding reached $10.1 billion in January 2025 which showed a 12.5% decrease from December 2024 but represented an 8.3% growth compared to January 2024. The overall investment environment appears more selective despite seeing a marginal annual increase.

Startups face higher capital costs due to elevated interest rates, while the market has shifted its obsession from growth-at-all-costs to profitability and capital efficiency. Corporate VCs — now involved in one out of every six deals — are transforming how term sheets get written.

This shift has left many founders stuck:

More equity dilution

Tougher investor expectations

Fewer yeses

No wonder so many are looking for alternatives to venture capital. For founders seeking control, stability, and sustainability, one answer is gaining traction: seed strapping.

🌱 What Is Seed Strapping? The Goldilocks Approach to Startup Funding

For years, founders had only two choices:

🧵 Bootstrap and grow from revenue — or

🚀 Raise VC and commit to the fundraising treadmill

But now there’s a third option: seed strapping.

Seed strapping is a startup growth strategy where founders raise a single seed round to build momentum — then grow with revenue instead of chasing more funding rounds. It’s the middle ground between bootstrapping and full VC.

How Seed Strapping Works:

Raise a modest seed round

Use AI, no-code tools, and automation to scale lean

Focus on early profitability, not burn

Avoid future equity dilution

Build on your terms

Unlike bootstrapping, seed strapping gives founders early capital without locking them into a Series A mindset. And unlike VC-backed startups, it doesn’t require hypergrowth to justify another round.

📈 Zapier, the poster child for seed strapping, raised $1.3M in 2012 and never took another round. Today, it generates over $140M in revenue and, as of 2021, is valued at over $5 billion.

🧨 The Myth of “More Rounds = More Success”

For too long, startup success was defined by how much you raised, not what you built.

But founders — and investors — are waking up.

Chasing multiple funding rounds often leads to:

Constant fundraising mode

Higher burn without profit

Investor pressure to grow fast or die trying

Meanwhile, a new generation of founders is proving you don’t need endless capital to scale.

Basecamp (now 37signals): bootstrapped to 7-figure revenue

Mailchimp: never took VC, sold for $12B

Zapier: thriving without ever raising a Series A

Micro-VCs and alternative funders are also embracing the shift — backing leaner, revenue-driven startups that can grow sustainably.

Founders are asking a better question:

“What if owning more of a real business beats chasing the next round?”

✅ Why Seed Strapping Is a Powerful Startup Growth Strategy

Here’s why more founders are choosing seed strapping in 2025:

More Control, Less Dilution

You raise once, keep your equity, and run the business on your terms. No board pressure. No growth-at-all-costs mentality.

Profitability Over Burn

VCs reward spending. Seed strappers reward revenue. The goal isn’t to raise again — it’s to fund your growth with cash flow.

Sustainable Growth

When you’re not optimizing for your next round, you can build more intentionally. Grow where it makes sense, not where investors expect.

🧨 The Hidden Burdens of Full VC Funding

There’s no denying that venture capital can help startups grow fast. But it comes with serious strings attached — and for many founders, the tradeoffs are no longer worth it.

When you raise multiple funding rounds, you enter a cycle where investors call the shots. That means chasing aggressive growth, delivering massive returns, and often compromising your own vision in the process.

Downsides of venture capital explained. Image courtesy of Lanturn.

🎯 Fundraising Becomes a Full-Time Job

Raising capital isn’t a one-and-done event — it can take months of pitching and follow-ups. Founders spend more time on decks and data rooms than building products, talking to customers, or scaling operations.

📈 Growth Pressure Breaks Focus

VCs push startups to scale fast — even when the market isn’t ready. Instead of building a sustainable business, many founders are forced into unnatural expansion just to justify their next round.

💸 Reckless Spending Is Common

With large checks come bad habits: over-hiring, inflated ad budgets, and scaling before product-market fit. Many VC-backed startups burn through cash without achieving long-term success.

🧠 The Mental Toll Is Real

The pressure to constantly raise more, hit investor milestones, and deliver unicorn growth creates intense founder stress. Many end up chasing validation through capital

🧭 How Investors View Seed-Strapped Startups: A Divided Perspective

As seed strapping gains traction, investor opinions are increasingly divided. While some see it as the future of capital-efficient startups, others view it as a missed opportunity for hypergrowth.

Many early-stage investors are embracing seed-strapped startups. Why? Because these companies operate with discipline. They spend wisely, grow sustainably, and don’t depend on continuous venture capital infusions to survive. With fewer funding rounds, investors benefit from less dilution and more ownership.

But not all investors are sold.

Late-stage VCs—those who thrive on fast exits and exponential scaling—often hesitate. Since seed-strapped companies aren’t chasing Series B or C rounds, these investors have fewer opportunities to increase their stake or fuel rapid expansion. The slower, more deliberate pace doesn't align with every fund’s return model.

That’s why the investor perspective is split: some value efficiency and ownership, others prioritize speed and scale.

🧪 The Hybrid Approach: Variations of Seed Strapping

Keywords: seed strapping, startup funding strategies, alternatives to venture capital, revenue-based financing

Some founders don’t want to choose between bootstrapping and VC. Instead, they’re developing hybrid funding strategies that combine the best of both worlds: control and optional capital.

💡 Seed Round + Revenue-Based Financing (RBF)

Startups can raise an initial seed round for early traction, then turn to non-dilutive funding through RBF platforms like Capchase or Lighter Capital. These options provide growth capital without giving up equity — perfect for startups focused on recurring revenue and operational efficiency.

🧱 Bridge Round for Extra Runway

Instead of a full Series A, some founders raise a small bridge round from existing investors or angels. This gives the business more runway while maintaining ownership and avoiding VC pressure. Companies like Buffer and ConvertKit have succeeded with this model.

🌐 Crowdfunding, Grants & Strategic Partnerships

After a seed round, founders can then turn to partnerships, grants, or crowdfunding to raise more capital. In 2024, global crowdfunding platforms were valued at over $17 billion, proving that it’s becoming more popular for startups to tap into their own communities for funding.

🔮 The Future of the VC–Startup Ecosystem

We’re witnessing a shift. Founders are rewriting the playbook — and so are investors. The old path (seed → Series A → unicorn dreams) is no longer the only route.

🦙 Goodbye Unicorns, Hello Camels

For years, tech media glorified unicorns — billion-dollar startups backed by big VC rounds. But today, many of those unicorns are unprofitable and overextended. In contrast, "camels" — resilient startups that grow slowly but survive market shocks — are on the rise. These companies prioritize profitability and endurance over blitz-scaling.

🤖 How AI Changed the Game

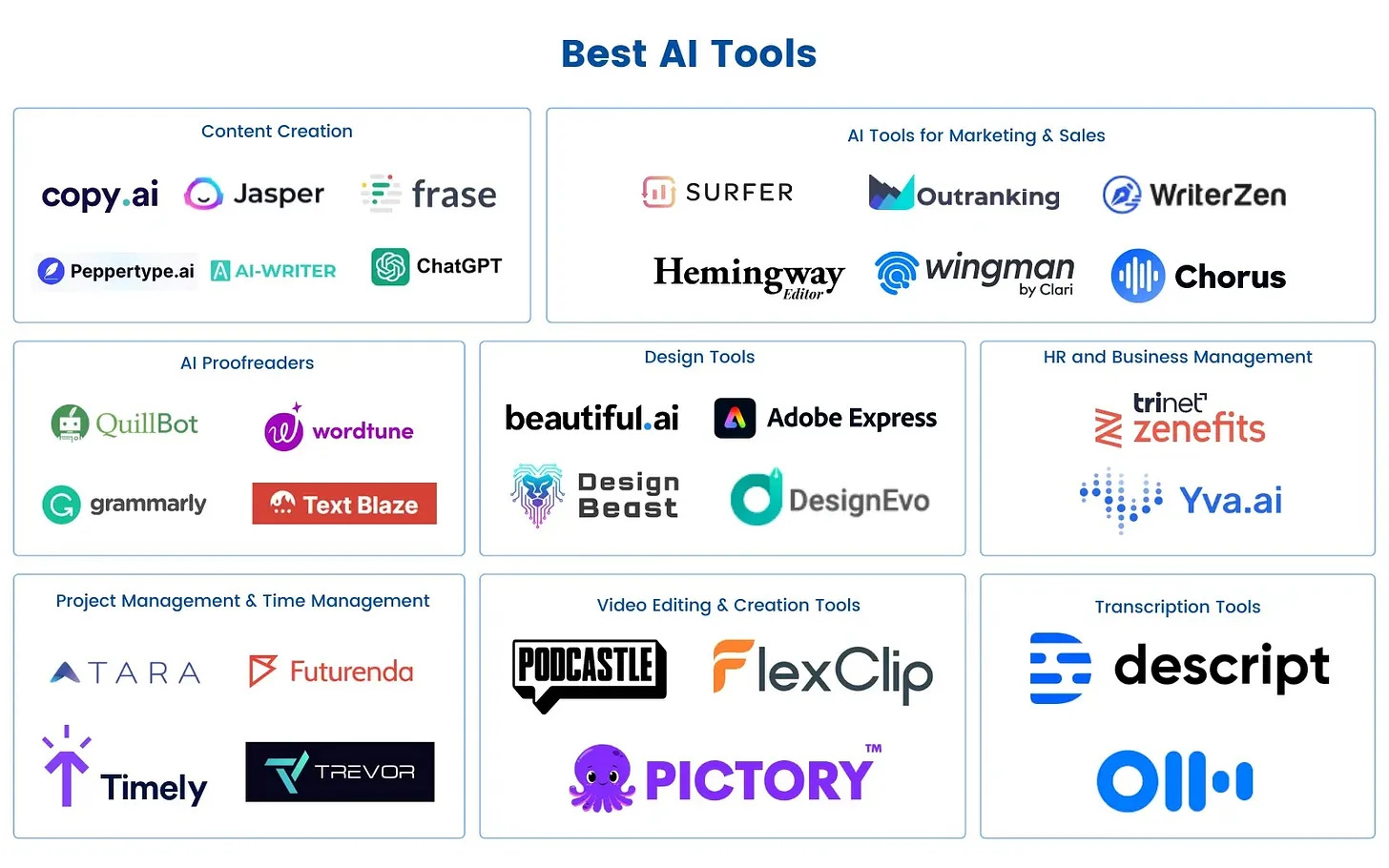

AI has made it easier than ever to build lean startups. What once required a team of 30 now takes 5 people using tools like ChatGPT, Notion AI, and Zapier. This operational leverage has shifted what’s possible on a seed budget.

No-code and low-code platforms eliminate the need for full engineering teams. Founders can go from idea to MVP without raising millions. That’s the power of the capital-efficient startup.

“The best founders today aren’t just builders — they’re operators.”

– Anonymous angel investor, 2025

🧠 The Rise of Founder-Led Growth

Communities like Indie Hackers, MicroAcquire, and SaaS Twitter have shown that founders can succeed without VC. These ecosystems are giving rise to a new wave of independent, profitable businesses — many of them seed-strapped.

The big question now is:

Will most startups still need venture capital in the AI era?

If a company can grow revenue, reduce burn, and retain control, the answer might increasingly be no.

📈Startup Growth Has Changed

For years, startup growth meant chasing VC, raising bigger rounds, and scaling at all costs.

Not anymore.

Seed strapping proves there’s a third path — one that’s not all or nothing. Founders can still raise capital, but on their own terms. They can choose sustainable growth over breakneck speed. They can build companies that are profitable, independent, and resilient.

And most importantly, they can own more of what they create.

The startup ecosystem is evolving — fast. AI, automation, and access to lean tools mean the barriers to entry have dropped. But the path to long-term success now depends on how efficiently you can scale without losing control.

Seed strapping might not be right for everyone. But for a growing number of modern founders, it’s becoming the smartest way to grow.

Nice insight! Seed strapping in a way, is going back the fundamentals of why and how we raise funds

Nice article, thanks. The idea makes sense from a founder perspective - But my experience is that investors won't bite. You address this briefly, saying "perspective is split" in the investment community, but I'd like to hear more discussions about what exactly these seed strapper investors expect, if not a payout from future rounds/ acquisition/ IPO.