SAFE Note Dilution: How to Calculate & Protect Your Equity (+ Cap Table Template)

Avoid Hidden Founder Dilution—Learn How SAFE Notes Work, Model Equity Impact, and Download a Cap Table Template to Stay in Control.

Raising capital isn’t just about securing funding—it’s about how much ownership you’re giving up. Many founders underestimate dilution when using SAFE notes and convertible notes.

Ignore the math, and you could own far less than expected. Once equity is gone, it’s gone.

This guide covers:

✅ How dilution works (and why it catches founders off guard)

✅ SAFE terms—discounts vs. valuation caps and their impact

✅ A cap table template to model your dilution before signing anything

Let’s dive in.

Brought to you by Vanta’s ISO 42001: Your Compliance Blueprint 🛠️

Achieving ISO 42001 Compliance demonstrates to your customers that you're committed to responsible AI usage and development. Vanta’s ISO 42001 Compliance Checklist helps you streamline the process, remove uncertainty, and meet requirements effortlessly. Simplify your compliance journey and achieve certification faster.

📥 Don’t let compliance hold you back

Understanding Dilution

Every time you raise capital or issue stock—whether to employees, advisors, or investors—your ownership percentage shrinks. This is dilution. But dilution isn’t inherently bad.

The key question is: Are you raising at a valuation that makes each remaining share worth more?

Would you rather own 100% of a $1M company or 10% of a $100M company? The goal is to grow the pie so that even a smaller slice is worth exponentially more.

The problem arises when founders unknowingly give away too much equity—especially in early rounds—because they don’t fully grasp how SAFE notes and convertible notes convert.

SAFEs: Discounts vs. Valuation Caps

Before raising a priced round (Seed, Series A, etc.), many startups opt for convertible debt or SAFEs (Simple Agreement for Future Equity). These instruments allow companies to raise money without immediately setting a valuation, delaying the dilution impact until a future equity round or exit event.

While new shares aren’t issued upfront, dilution is inevitable once these instruments convert into equity—often at more favorable terms than those given to later investors. This makes understanding how SAFEs dilute ownership crucial for founders looking to maintain control.

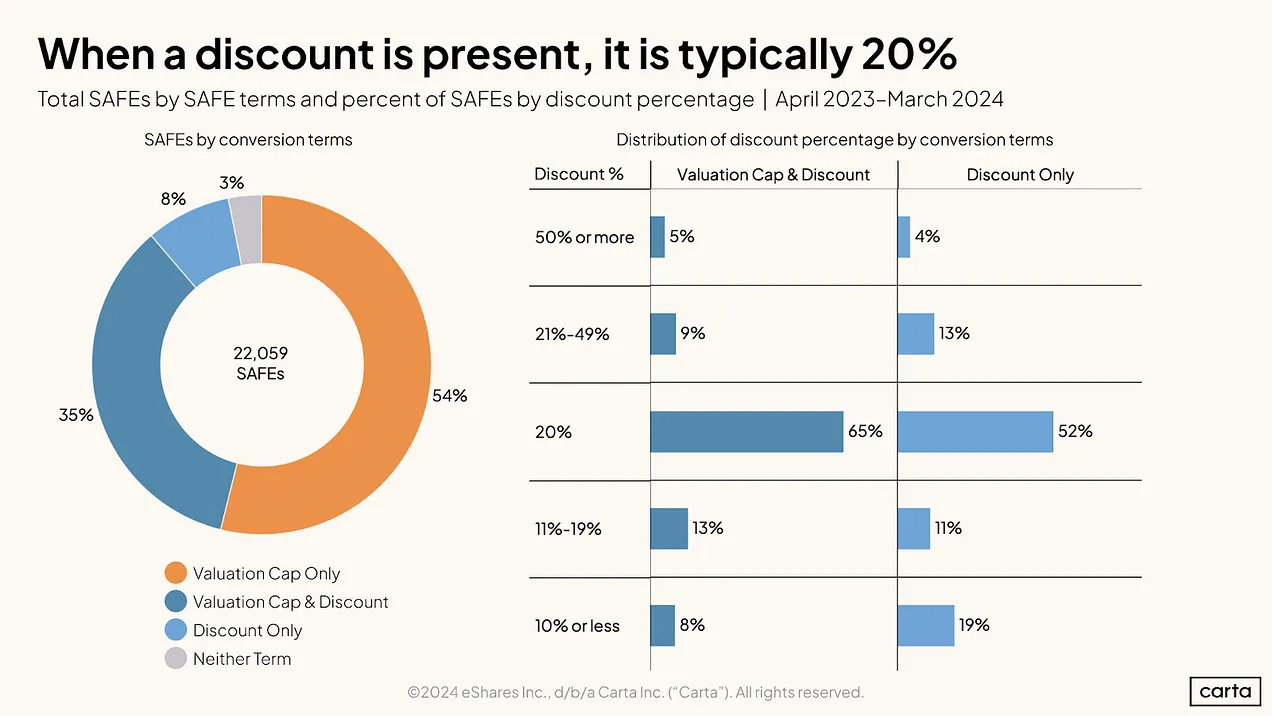

SAFE investors accept higher risk by investing before a valuation is determined, so they receive built-in advantages like:

Discounts—allowing them to convert at a lower price than new investors.

Valuation caps—ensuring their conversion price remains favorable, even if the company scales rapidly.

Here’s how each impacts founder equity and investor ownership:

1. Discounts: Lower Conversion Prices for Early Investors

A discount allows SAFE investors to convert their investment into shares at a reduced price compared to new investors in the next funding round. This is a reward for investing early and taking on more risk.

Example:

A SAFE carries a 20% discount on the next round’s valuation.

The startup raises its next priced round at a $10 million pre-money valuation.

The SAFE investor’s conversion price is based on an $8 million valuation (80% of $10M).

This means SAFE investors get more shares per dollar compared to new investors in that round.

When Discounts Work Best

✔️ Discounts benefit SAFE investors most when the next funding round’s valuation is relatively modest, allowing them to convert at a meaningfully lower price.

✔️ However, if the next round’s valuation skyrockets, they may wish they had a valuation cap instead, which could have secured them an even lower conversion price.

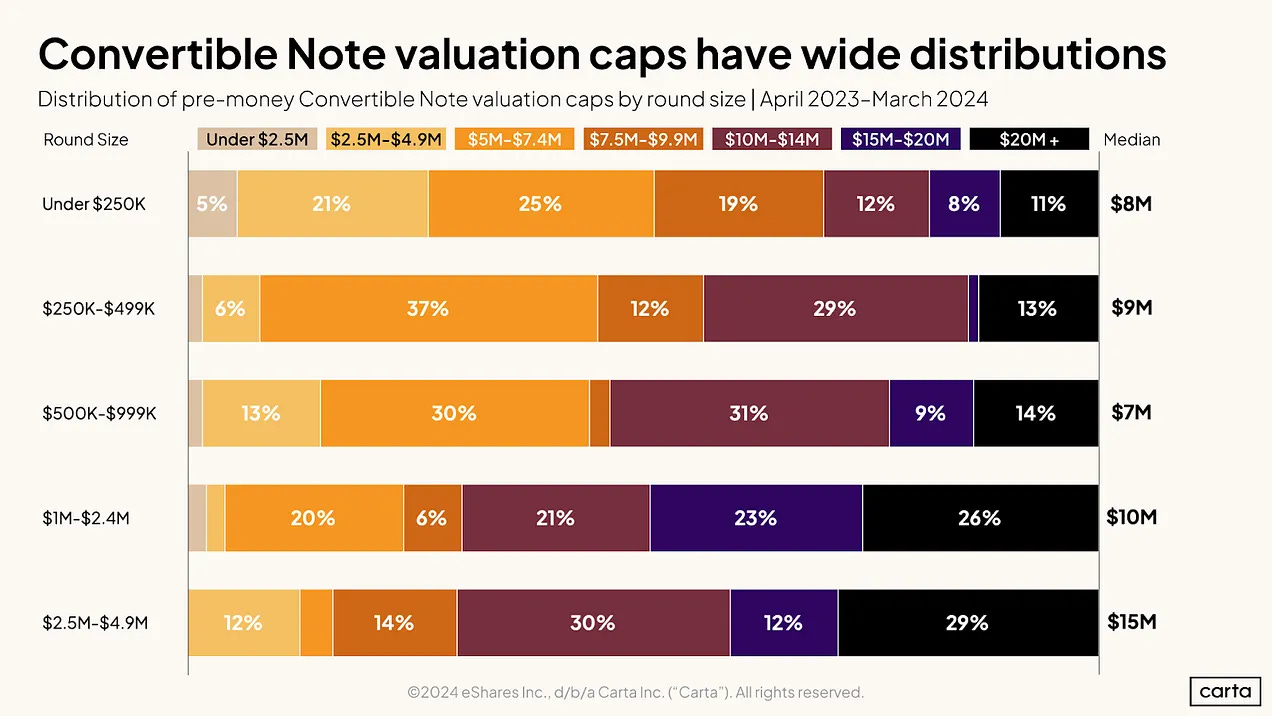

2. Valuation Caps: Locking in a Maximum Conversion Price

A valuation cap places a ceiling on the valuation at which a SAFE converts, ensuring early investors receive shares at a favorable price—even if the startup's valuation soars before the next funding round.

Example:

A SAFE has a $5 million valuation cap.

The startup’s next priced round is raised at a $10 million valuation.

The SAFE investor still converts at $5 million, securing shares at half the price of new investors.

This mechanism protects early investors from excessive dilution, ensuring they lock in a preferential equity stake relative to the company’s post-valuation growth.

Pre-Money vs. Post-Money SAFE Valuation Caps: What Founders Must Know

SAFE valuation caps come in two structures, and founders must understand their impact:

Pre-Money Valuation Cap

Applies to the company’s valuation before considering the capital raised.

If there’s no limit on how much can be raised before conversion, SAFE investors may not know their final ownership stake until the round closes.

Post-Money Valuation Cap (Preferred by Investors)

Includes all SAFEs and convertible instruments in the valuation.

Investors know exactly how much equity they will receive, regardless of how much additional funding is secured.

Since Y Combinator’s 2018 SAFE update, post-money caps have become the industry standard, offering investors greater clarity.

When Valuation Caps Work Best

✔️ Valuation caps favor investors when a startup raises at a much higher valuation in its next round.

✔️ If the startup raises below the cap, the cap has no impact—investors will convert at the actual round price instead.

How Discounts and Valuation Caps Work Together in SAFEs

Some SAFEs contain both a discount and a valuation cap. In this case, the SAFE investor gets the best possible deal by converting at the lowest price:

✔️ If the company’s valuation is below the cap, the investor uses the discount to convert at a lower price.

✔️ If the valuation exceeds the cap, the investor converts at the cap price rather than the discount.

This creates uncertainty for founders, as the final equity dilution isn’t determined until the next priced round occurs.

Why Founders Must Be Cautious with SAFE Terms

While SAFEs simplify early-stage fundraising, their dilution impact can be substantial. A steep discount or low valuation cap can result in:

🔹 SAFE investors owning a larger share than expected.

🔹 Founders losing leverage in future funding rounds.

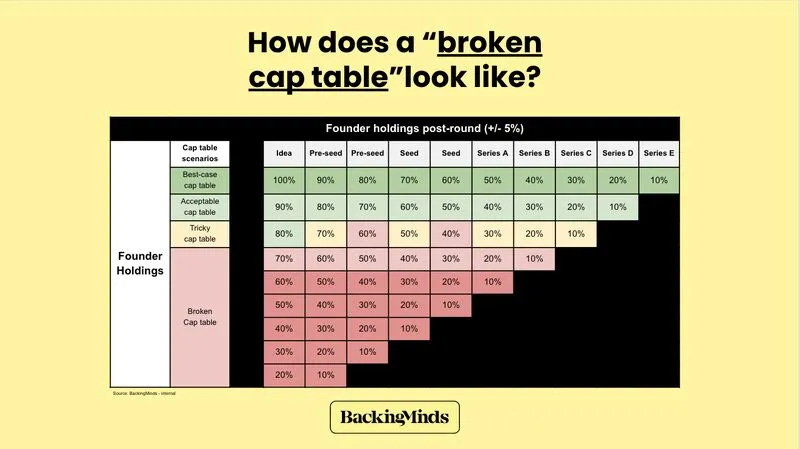

🔹 A cap table too messy for VCs, making follow-on fundraising harder.

Questions Founders Should Ask Before Agreeing to a SAFE:

✔️ How much equity will SAFE investors receive at different future valuations?

✔️ Will I still own a meaningful percentage of my company after conversion?

✔️ Will these terms affect my ability to raise from institutional VCs?

Many founders underestimate how much equity they give away with multiple SAFE rounds—until they reach a priced round and realize they own far less than expected.

How to Choose Between Discounts and Valuation Caps

The best SAFE terms depend on your startup’s fundraising timeline and expected valuation growth:

✔️ If you plan to raise soon, a valuation cap may be reasonable, as you can predict revenue and fundraising expectations.

✔️ If your next round is uncertain, a discount-only SAFE may be safer, preventing excessive dilution if your valuation increases significantly.

Investor Considerations: Why Too Much Dilution Can Hurt Your Next Round

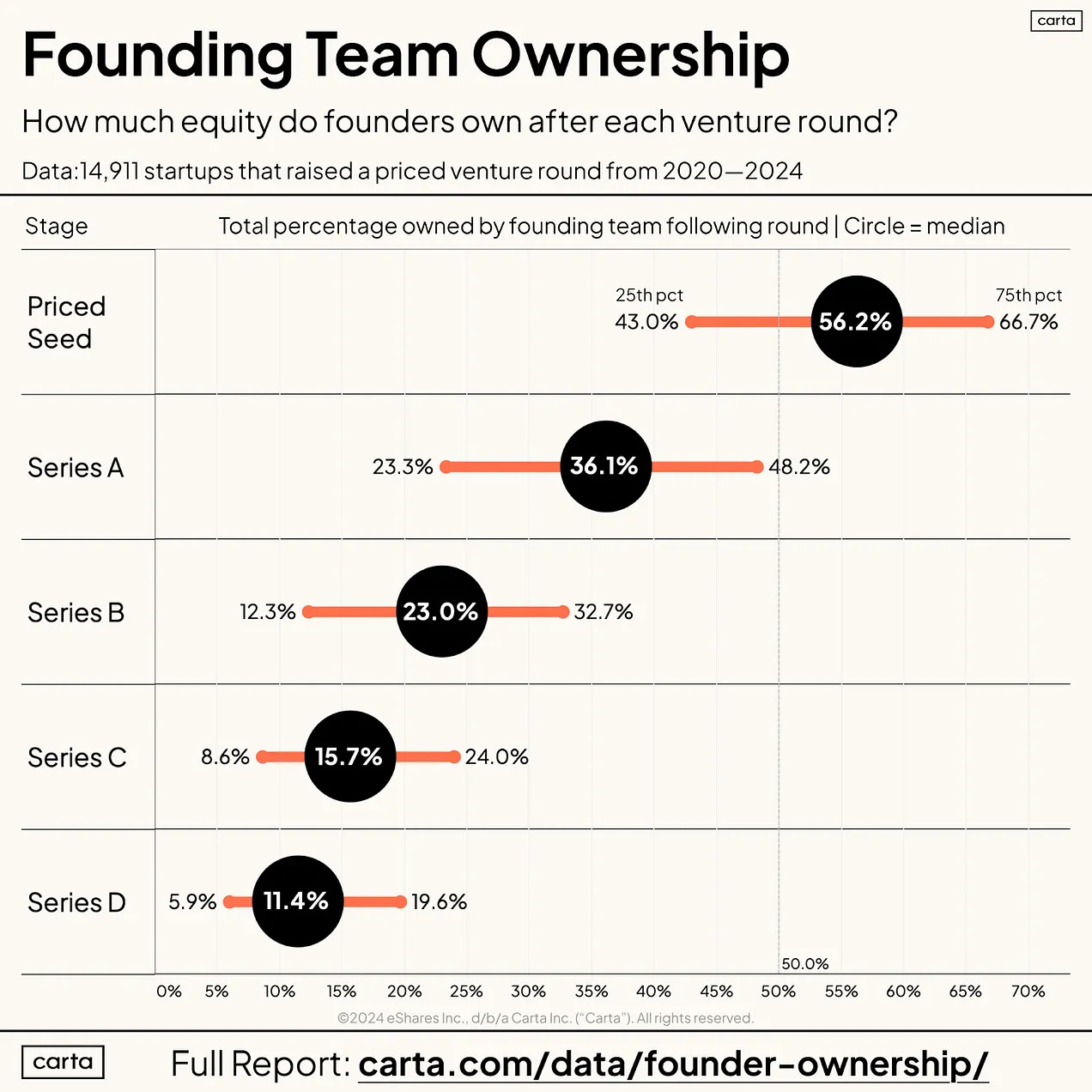

Institutional VCs often hesitate to invest when founders have already given away too much ownership. Before writing a check, investors assess:

✔️ Founder ownership: Will the team stay motivated long-term?

✔️ Cap table clarity: Are there too many SAFEs or convertible notes with conflicting terms?

✔️ Investor alignment: Will new investors get favorable terms, or are early SAFE holders getting too much upside?

If early investors own too much equity, it can create friction in future funding rounds, making it harder to raise money at good terms.

Cap Table Scenario Planning: Don’t Let Dilution Catch You Off Guard

Raising capital isn’t just about securing funding—it’s about managing dilution like a pro. Too many founders sign SAFEs without modeling their long-term impact, only to wake up post-Series A wondering how they lost so much equity.

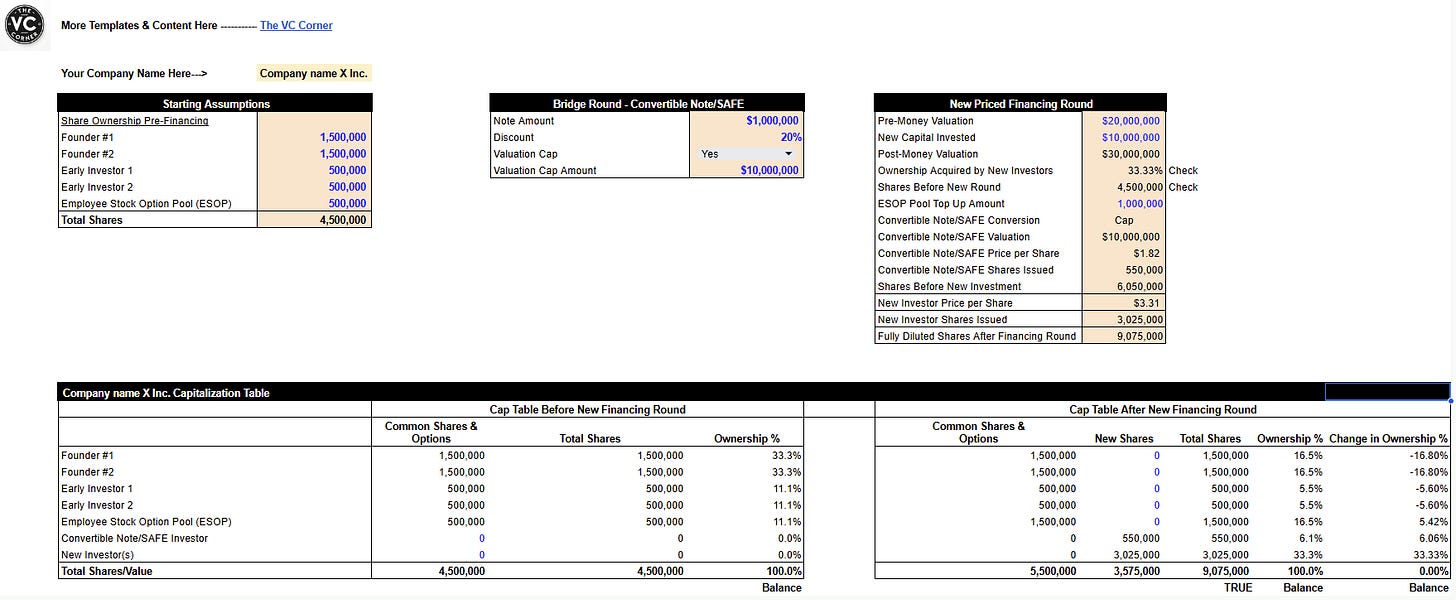

To help you stay in control of your ownership, The VC Corner has created a cap table template that lets you:

✔️ Visualize dilution across different SAFE terms (discounts, valuation caps, investment amounts).

✔️ Simulate multiple funding scenarios to see how future rounds impact your stake.

✔️ Avoid surprises by understanding exactly what early investors will own post-conversion.

If you’re not premium subscriber yet, you’re missing out. Sign up to get investor lists, pitch breakdowns, and fundraising playbooks—straight to your inbox.

✅ Ultimate Investor List of Lists (+10k Investors)

✅ 18 AI Communication Agent Use Cases

✅ AI Co-Pilots Every Startup & VC Needs in Their Toolbox 🛠️

✅ The Startup Founder’s Guide to Financial Modeling (7 free templates included)

✅ The Best 23 Accelerators Worldwide for Rapid Growth (and How to Get Into Them)

✅ The Ultimate Startup & Venture Capital Notion Guide: Knowledge Base & Resources

As a premium subscriber, you will get access to all the above ones, + all the best resources The VC Corner has ever published.

Find the Cap Table Template and get access to the rest of the resources below 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.