How Two European Founders Raised $4M, Secured a Microsoft Deal, and Broke Into Silicon Valley

From Zero Network to Millions Raised—How They Cracked Fundraising, Scaled to Millions of Users, and Closed a 10-Year Microsoft Deal

Most founders struggle to break into VC circles. Daniel Olmedo and Begoña Fernández-Cid found another way.

With no network, no warm intros, and no prior experience, they raised $4M, scaled to millions of users, and secured a 10-year partnership with Microsoft.

Here’s how they did it.

Brought to you by Attio - The AI-native CRM

Attio is the CRM for the AI era. Connect your email, and Attio instantly builds your CRM—every company, contact, and interaction enriched and organized.

Automate email sequences, generate real-time reports, and leverage AI-powered workflows to streamline complex processes. Focus on what matters: building your company.

Trusted by Flatfile, Replicate, Modal, and more. Try the CRM built for the future—start a free Attio trial today.

"Fundraising is a numbers game. We pitched 175 investors. 166 passed. But those 9 ‘yeses’ changed everything."

Daniel Olmedo and Begoña Fernández-Cid are founders of the companies EasyVC, a fundraising tool to automate investor research using AI and get warm introductions from portfolio founders, and Nware, a cloud gaming platform that enables gamers to play any demanding video game on any device.

At just 23 and 24, we took a leap into entrepreneurship with no prior experience and no connections in the field. For a year and a half, we navigated a cycle of trial and error before securing our first round of FFF (Friends, Family, and Fools) funding, marking the moment we went all in on our venture.

What followed was a journey that took us from the early-stage struggles to Silicon Valley, securing venture capital, scaling our platform to millions of users, and found ourselves at the negotiating table with Microsoft’s board to close an industry-defining multi-year partnership covering all Activision-Blizzard games.

We made plenty of mistakes along the way, but the two things we got right—and likely the most significant drivers of our success—were these: 1) we refused to take “no” for an answer, and 2) we played a numbers game.

Regarding the first principle, later on, and thanks to our time in Silicon Valley, we learned from the most successful founders and investors that “hacking your way through challenges” is a mindset deeply ingrained in the Bay Area culture.

Throughout our years of entrepreneurship, we’ve had the privilege of engaging in small circles with renowned investors and founders, having conversations such as this:

“…if you are fundraising, and you don’t find your way into all the investor events to which you have not been invited, I would think twice about whether you are investable or not”,

“…not having a lead investor shouldn’t prevent you from creating tranches in your round and start closing the small tickets”,

“…is there a way we can make this work with this new regulation?”

We’ve also seen the opposite—founders feeling stuck because they found a product that people want to pay for, but it took them many years of consulting, pivoting and testing. When they later went on to seek investors, their company seemed “too old”. But going back to this “hacker” mindset—who says you can’t incorporate a new company, keep the resources of the previous one, and start the new company from the learnings of your previous one?

The challenge itself is the same, but how you approach the problem can be changed. These are little examples of how exceptionally successful people have a broader way of looking at problems.

When faced with seemingly impossible tasks, most people default to doing “what’s expected” of them. However, as a founder, 99% of the tasks that you need to accomplish in order to have a successful business will seem impossible, daunting and full of rejections, so doing what’s expected won’t cut it.

From going viral to making investors take the leap on you to closing partnerships with publicly traded companies, the common pattern we followed every single time was asking ourselves, “Is there a way we can actually make this happen?” In other words, how can we make the impossible possible?

Playing a numbers game

This mindset of not taking “no” for an answer will be the fuel you need to go through challenges, but it’s often hard to take control and steer it towards positive results. Most of the time you need some kind of knowledge in order to find an efficient way forward, but if I’m starting at something, how do I make good decisions? This is the second of the two principles I mentioned at the beginning.

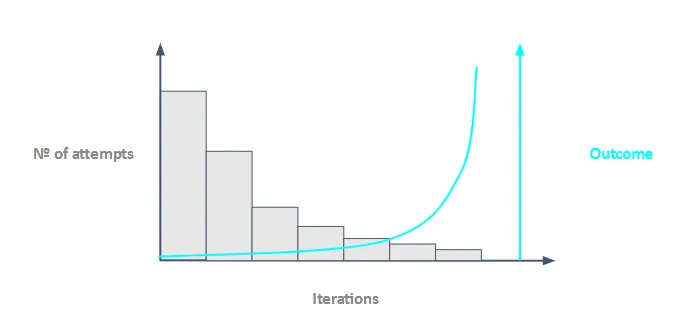

Action creates information, so the best way to create predictability in your results is by playing a numbers game. The more attempts you make to reach a specific goal, the faster you fail, the quicker you learn and the better choices you make, and therefore the higher the probabilities of being successful at that task. This principle applies to countless scenarios: becoming a great basketball player, making sales, finding a job, going viral, investing in startups, finding Product-Market-Fit or startup fundraising, among others.

Again, this approach only works when each attempt is backed by a quality component, thoughtful planning, and a willingness to learn, which translates into making better decisions. For example, spamming recruiters with a poorly crafted resume won’t land you a job. Similarly, sending irrelevant cold emails will likely make you end up in spam folders, and testing features no one cares about won’t gain you traction. Success comes from refining your attempts with each iteration. Think of it this way: the more you practice your basketball shots, the more likely you are to score points. The more sales calls you make, the greater your chances of closing deals. Going back to our own experience, every time we aimed for something, we inherently treated it as a funnel process:

This three-dimensional chart represents what “playing a numbers game” means. Action (i.e. the number of attempts) produces information. That information helps you advance from left to right in the chart. Since you take more refined actions based on the attempts (iterations), the number of attempts needed for a similar outcome decreases significantly over each iteration. The more you engage in this action-iteration cycle, the higher the probability of generating higher positive outcomes (getting the job, scoring goals, creating a successful company, launching a killer feature). That’s the main reason most successful people are extremely obsessed with something—They’ve probably spent their entire lives iterating over a certain goal. But one last bit many people do not realize before taking on a hard task is that there is a “compounding effect” that goes into producing, learning, iterating, obtaining results, and repeating, even if the effort decreases over time. This compounding effect takes the form of generating momentum and attracting success. Other people take notice, and that is because you are doing something that most people will not even try, because they have given up way too early. Simply put, you are doing what only the 1% do.

Our “hack” to raise from Venture Capitals - Building warm introductions without having a network

According to Forbes, less than 1% of startups will raise capital from investors. Therefore, if you’re going to raise capital, you need to turn the odds in your favour by reaching a sufficiently significant number of investors to create certainty in your results. In our case, we reached out to approximately +70 investors for our pre-seed round, and 175 investors for our seed VC round, where 166 investors passed. If you’re fundraising, you have to factor in rejection, so expect to get at least 99 “no”s before the first “yes”.

Going back to the numbers principle, at the beginning of the journey we made dozens of big mistakes. Our first pitches were pretty bad, long, complex and not straightforward. We reached out to too few investors and they were the wrong investors. We let investors take the wheel of the timings of the round. We didn’t generate any sense of urgency. The results at the beginning were horrible and fundraising for us was never easy. However, once we started playing a numbers game and treating fundraising in a strategic way, we started making better decisions and getting better results.

After years of raising from investors, these are the most important insights we’ve learned:

The most obvious one, you need to play a numbers game. You need to speak with as many investors as possible until you find the right partner. The more quality investors you find, the better, meaning those who align with your sector, investment stage, geography, B2B / B2C-focused, among other factors.

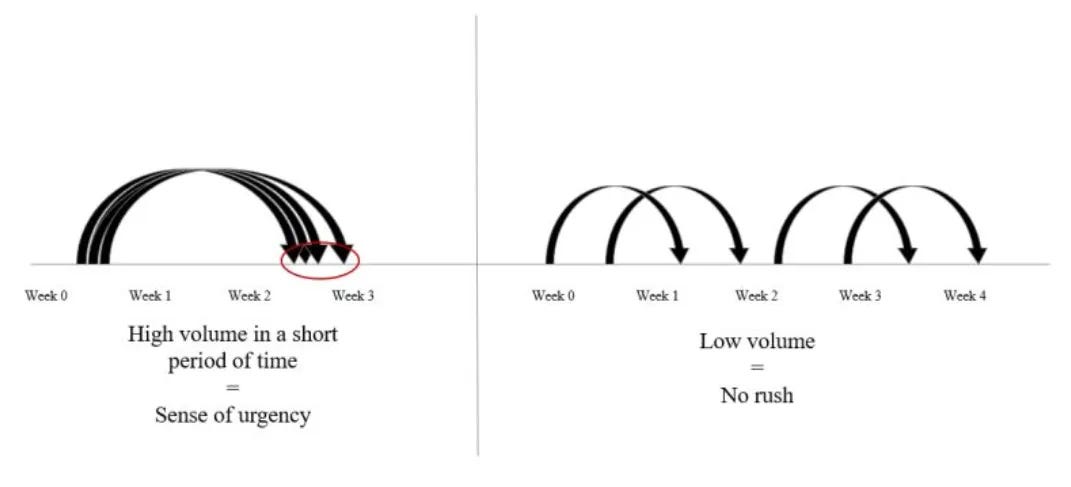

The most important question investors need to answer to take the leap on your company is: “Why now?”. If they don’t feel there is a sense of urgency, they’ll keep kicking the can forward. This will only happen when they sense that other investors are interested in the deal, even if your company is skyrocketing in MRR. It all comes down to investors thinking, “if I don’t act quickly, somebody else will take this deal, and I’ll be left out”.

The success of your round depends on two factors: 50% depends on how strong your company is, and the other 50% depends on how well you run the fundraising process. To run a successful round, you need to create a sense of urgency among investors. The only way to do that (if your MRR is not growing at an insane rate, like 300% MoM) is to generate a density of meetings. When other investors see that progress is being made in the round and realize you’re in talks with others at the same time, it creates a sense of urgency. The question “Why now?” becomes hard to ignore.

Fundraising is a full-time job for the founder. You need to plan accordingly, understanding that while you’re raising capital, you’re also running a business. Balancing both requires significant time and energy, so be prepared for the workload.

We’ve talked about getting meetings with 100 investors as if it were easy, especially for founders without an established network.

As young entrepreneurs from Spain, a country with an ecosystem less developed than places like Silicon Valley or London, securing meetings with relevant investors was a great challenge for us. We tried everything, from cold emailing them, to pitching at major events like TC Disrupt, South Summit, Web Summit and Emerge Americas. For founders without strong connections, getting a meeting with a VC felt nearly impossible.

So, what did we do? Instead of directly contacting the investors we were targeting, we connected with founders who had already raised money from them. We would study a VC’s portfolio companies and identify potential points of connection, whether it was being in the same industry, sharing similar challenges, or something else that made us relevant.

This hack turned out to be the most powerful strategy we used in our fundraising rounds. It grabbed investors' attention and created a sense of urgency from the very first interaction.

When a portfolio founder makes a warm introduction to their investor, the investor receives the deal from a trusted source. This shifts the power dynamics in your favor. Why? Because the investor perceives that you’re in an ongoing funding round with access through their close network, which makes it seem like the round is already in advanced stages. They assume you’re already dealing with interested investors, which builds authority around you as a founder.

We followed this process for every target VC outside our network. To give you some numbers, for every VC we reached out to, we connected with an average of 15 founders on LinkedIn. Of those 15, we closed a 15-minute video call with 3. From those 3, we always ended up getting a warm intro from one or two of the founders we spoke with.

With this process, we created a repeatable system of warm introductions, allowing us to consistently maintain a high volume of meetings with investors. We played the numbers game, iterated and learned quickly, and increased the sense of urgency in our round.

Above all, this hack helped us secure investment from institutional investors, which later enabled us to move to Silicon Valley.

Along the way, we’ve helped many founders, and after some time, we decided to create EasyVC, a platform designed to help founders automate the entire process by using AI for investor research and automating LinkedIn outreach to portfolio founders.

How we closed a global 10-year partnership with Microsoft for all Activision Blizzard games

When you’re a small startup, you’re used to hearing “no” a lot. But if there’s one thing we’ve learned, it’s that “no” just means “not yet.”

At Nware, we built a cloud gaming platform that lets gamers play any game on any device, syncing their libraries from Steam, Epic Games, Ubisoft, and more—over 20,000 titles. We were a scrappy European startup trying to make our mark in a space dominated by giants.

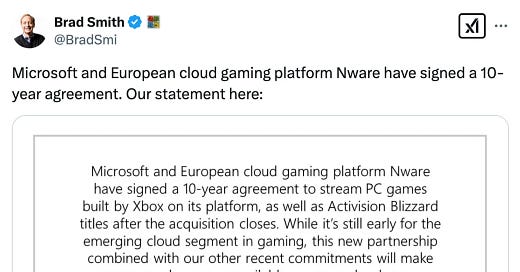

Then, in 2022 and 2023, the gaming industry went into full meltdown mode. Microsoft was trying to close a $69 billion acquisition of Activision Blizzard, the biggest deal in video game history, but regulators worldwide blocked it. The European Commission (EC), the UK’s Competition and Markets Authority (CMA), and the US Federal Trade Commission (FTC) weren’t convinced the deal would be good for competition.

Microsoft had announced a partnership with Nvidia GeForce NOW. For us at Nware, this news was both exciting and worrying. Nvidia, a publicly traded US tech giant and competitor, was about to get all Activision Blizzard games on their platform.

However, as a European cloud gaming service, we realized we could actually help solve Microsoft’s problem. If they truly wanted to convince regulators they weren’t monopolizing cloud gaming, a joint collaboration would affirm Microsoft’s statement in providing access to other players in the European gaming ecosystem, alleviating the blockage. So, instead of waiting around, we took action.

The founding team gathered to strategize, researching the key decision-makers at Microsoft who could champion our vision. We proactively contacted Microsoft executives to share our interest in supporting this strategy.

Three days later, we received an email response from the VP responsible for these Microsoft strategic deals, who was intrigued by our outreach. We could have resigned ourselves to the idea that a company of that magnitude would not pay attention to us. But, as we mentioned previously, if there was a way forward, we were going to find it and make it happen.

The timing couldn’t have been better. Days later, right after the UK’s Competition and Markets Authority (CMA) ruled against Microsoft’s acquisition of Activision-Blizzard, we jointly announced our global 10-year partnership with Microsoft to bring Activision-Blizzard games to Nware. This was exactly the kind of move that could help Microsoft prove they weren’t creating a monopoly.

The agreement, pending the successful completion of the merger, would enable Nware’s users to stream all Xbox and Activision games and play them on any device. This includes World of Warcraft, Overwatch, Diablo, and the world-famous Call of Duty franchise, one of the most valuable properties within the video game industry. The underlying agreement was the commitment for Call of Duty to remain non-exclusive to Xbox, allowing stakeholders in the cloud gaming space, like Nware, to access that catalog.

The response was insane. Media outlets like VentureBeat, Reuters, and Engadget covered the story, bringing millions of impressions and spotlighting Nware as a key player in the cloud gaming landscape.

All of this happened because we didn’t wait for permission. We saw an opportunity, moved quickly, and made it impossible for Microsoft to ignore us. And if there’s one thing this experience reinforced for us, it’s that no startup is too small to think big, as long as you’re willing to put yourself in the conversation.

Our journey from young entrepreneurs with no network or previous experience in the startup world to raising capital and closing deals with tech giants like Microsoft exemplifies the two core principles:

Refusing to take "no" for an answer – whether it was reaching out to Microsoft executives, or pitching 175 investors (while 166 passed), every rejection was just a step closer to the right opportunity.

Treating every challenge as a numbers game, where each attempt, each conversation, and each setback gave us insights to refine our approach and increase our odds. The more shots we took, the better we got.

If there’s one lesson we’d share with fellow founders, it’s this: Persistence is not just a trait, it’s actually a strategy. Keep iterating, keep knocking on doors, and eventually, one will open. And when it does, make sure you’re ready to walk through it.

EasyVC to help founders navigate their fundraising journey easier

This journey has been incredibly enriching for us, and it’s what inspired the creation of EasyVC. Fundraising is one of the hardest challenges founders face—and it definitely was for us. It demands resilience, strategy, and the ability to hear "no" hundreds of times while still pushing forward. We’ve felt the frustration of not knowing where to start or how to get the right introductions, especially without a network.

EasyVC was born from the lessons we learned, the systems we built, and the success we achieved through persistence and creativity. With this platform, we aim to level the playing field for founders everywhere, providing them with the tools they need to discover investors, build connections, and run an efficient fundraising process with the same tools we used to raise $4M.

Our mission is simple: to make fundraising less of a hurdle and more of an enabler for founders with great ideas. Whether you’re raising your first round or scaling your vision, EasyVC is here to help you navigate the journey with confidence.

At EasyVC, we’ve created a platform and a new playbook that will empower the next generation of founders to achieve their milestones, secure the funding they need, and bring their dreams to life.

1) "The more attempts you make to reach a specific goal, the faster you fail, the quicker you learn and the better choices you make, and therefore the higher the probabilities of being successful at that task."

The great thing is that markets are perfectly honest. They'll tell you what works and what doesn't. If you're able to avoid taking its feedback personally, you'll go places.

2) Love the Nware-Microsoft story. It's the perfect example of how to advance your own interests by recognizing and advancing others' interests.