How Trump’s 2025 Tariffs Could Reshape Startups

Explore the impact of Trump’s new tariff policy on startups—rising costs, longer sales cycles, VC pullback, and how founders can adapt in this new trade landscape.

Trump’s New Tariff Policy Just Changed the Game for Startups

On April 2, President Trump unveiled a sweeping trade overhaul—“Liberation Day”—imposing a 10% baseline tariff on all imports, with steeper rates for specific countries and products. It’s positioned as a move to protect U.S. manufacturing and correct trade imbalances.

But this shift isn’t just rocking global supply chains. It’s already hitting startups.

✅ Hardware costs are rising

✅ SaaS sales cycles are slowing

✅ VCs are growing more cautious

Founders who thought tariffs were a “big company problem” are now recalculating burn, margins, and go-to-market timing. Whether you build software or physical products, this affects you…

Brought to you by The Ultimate Guide to Compliance for Startups

Want to scale without compliance headaches? Download Vanta’s Customer Guide for Startups to streamline your security and build trust with investors and customers.

✅ Easy steps to get compliant

✅ Save time & resources

✅ Tailored for startups in EMEA

… And here’s the kicker: Startups that adapt early won’t just survive—they’ll gain an edge.

This is a moment to rethink supply chains, funding strategy, and pricing models. The next 6 months will separate the reactive from the resilient.

Table of Contents

Rising Costs: Supply Chains, Hardware, and Physical Products

The Demand-Side Shock: Uncertainty and Shifting Buyer Behavior

Capital Crunch: Fundraising, VC Behavior, and the Denominator Effect

Exit Chill: IPOs and M&A Under Pressure

Strategic Pivots: Tariffs as a Catalyst for Reinvention

Efficiency Era: AI, Automation, and the Push for Lean Ops

Practical Playbook for Founders and Investors

Expert Signals and Founder FAQs

1. Rising Costs: Supply Chains, Hardware, and Physical Products

One of the most immediate consequences of the new tariffs is the jump in costs, especially for startups that rely on importing parts or producing physical goods. For hardware companies, this shift is already proving painful.

Hardware Startups Are on the Front Lines

Startups building electronics, robotics, IoT devices, medical tech, and mobility products are among the hardest hit. Many of these businesses depend on parts manufactured in China, Taiwan, or South Korea, which are now facing tariffs as high as 34%. That increase doesn’t just affect the price of components; it cascades through the entire product, from assembly to packaging to shipping.

Supply Chains Are Being Rebuilt in Real Time

Supply chains that were once optimized for speed and cost are suddenly bottlenecked or more expensive to maintain. A company that once relied on just-in-time delivery from Shenzhen may now be scrambling to source from Vietnam or Mexico, or considering domestic production at higher prices.

“Startups need to rethink supply chains, pricing models, and go-to-market timing. Playing defense early will open room to play offense later.”

Lomit Patel, Growth Advisor

Even Software Isn’t Immune

Even software startups aren't completely insulated. Many rely on cloud infrastructure or embedded hardware that is imported or managed abroad. If your servers run on equipment now subject to tariffs, or if your enterprise customers are cutting back due to rising costs of their own, you’ll feel the impact.

Higher costs don’t always show up in one place. Sometimes they show up as slower product launches, tighter margins, or frustrated customers. But they’re showing up, and fast.

2. The Demand-Side Shock: Uncertainty and Shifting Buyer Behavior

While rising costs are grabbing headlines, demand is shifting just as quickly. Startups are seeing signs that buyers - especially on the enterprise side - are pulling back, slowing down, or rethinking their decisions.

Sales Cycles Are Getting Longer

B2B customers are hesitating. Uncertainty around tariffs, future pricing, and global trade is making procurement teams more cautious. Deals that might have closed last quarter are now stuck in extended reviews. Sales pipelines in similar macro conditions are shrinking as CFOs delay non-essential spending. Early signals suggest that pattern may be repeating.

Local Preferences Are Reshaping Global Demand

International buyers are recalibrating, too. In Europe, where U.S. imports are now more expensive, the “buy local” sentiment is rising. Buyers are starting to favor regional vendors and flag anything priced in USD.

“The biggest impact won’t be on our costs—it’ll be on demand. If the economy slows, businesses pull back, and that hits our top line.”

Vineet Jain, CEO of Egnyte

Not All Products Are Equally Vulnerable

The impact isn't evenly distributed. Mission-critical tools - like compliance automation, security, and infrastructure - are holding up better than discretionary or experimental software. When uncertainty rises, customers prioritize stability and core operations.

SaaS and AI May Still Hold the Line

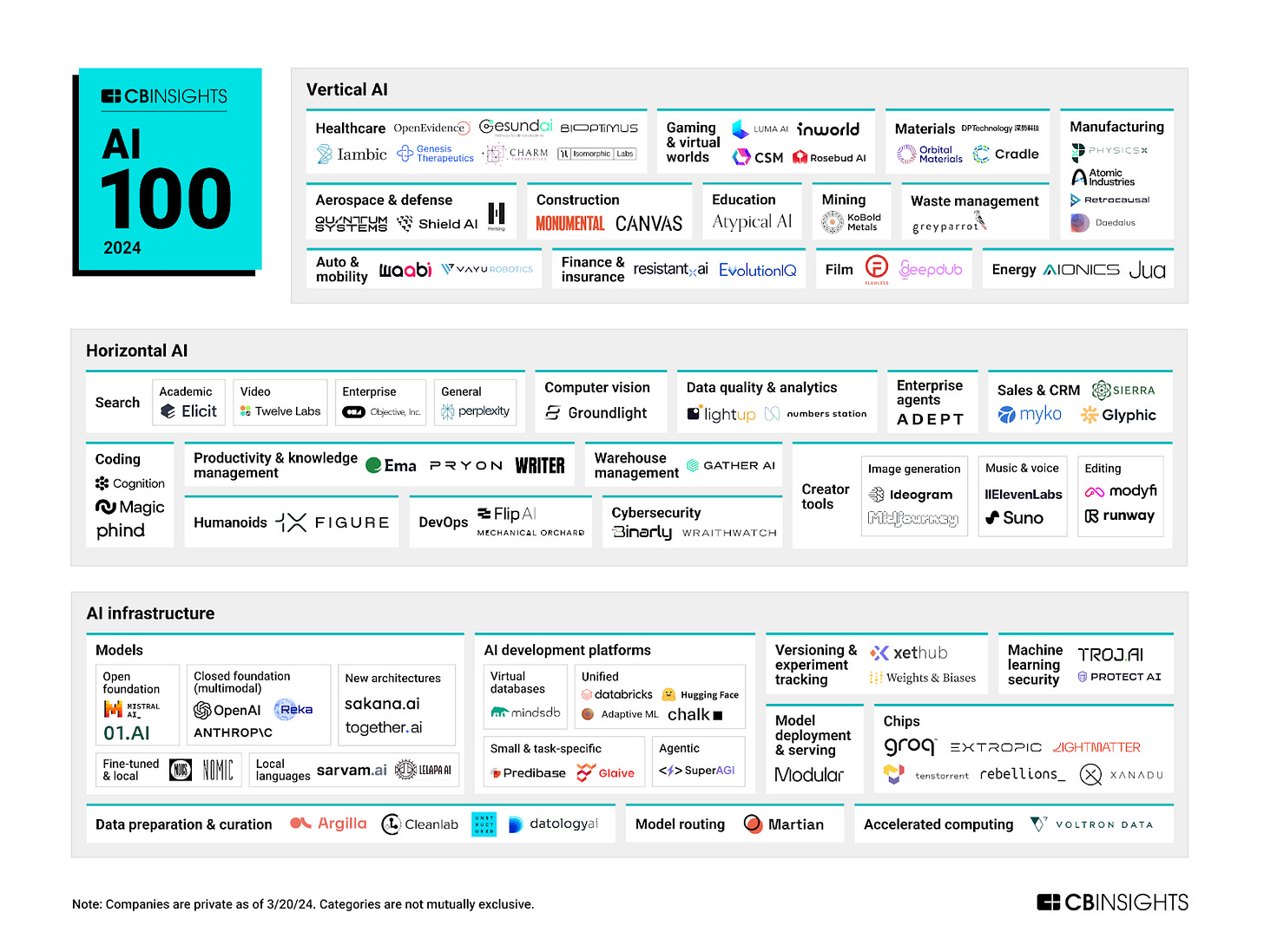

Startups with high-margin SaaS models or automation-focused AI offerings may even see increased demand. As companies look to reduce costs and boost productivity, tools that help them operate more efficiently are becoming more valuable. Tariff-related volatility could speed up AI adoption among large enterprises. Check out some of the most promising AI startups according to CB Insights:

3. Capital Crunch: Fundraising, VC Behavior, and the Denominator Effect

Capital thrives on confidence. Tariffs don’t just add costs, they rattle the broader economic picture. That uncertainty is now spilling into venture capital, and it’s beginning to reshape how startups raise, deploy, and think about funding.

Volatility Slows the Flow of Capital

The sharp swings in public markets following the tariff announcement have made limited partners more cautious. When public portfolios shrink, LPs tend to pull back from private markets. This is the denominator effect in action, and many VC firms are already adjusting. Smaller fund sizes, slower deal pacing, and tighter internal benchmarks are becoming more common.

Valuations Are Getting a Reality Check

Even great startups are starting to feel valuation pressure. Investors are demanding cleaner metrics, stronger unit economics, and more downside protection. Terms are shifting. That includes more structured deals, extended diligence timelines, and a stronger preference for startups that are either highly efficient or strategically positioned within tariff-insulated sectors.

Bridge Rounds and Burn Rate Discipline

With uncertainty in the air, many startups are choosing survival over speed. Bridge rounds are back in play, not as desperation moves, but as strategic tools to extend runway. Founders are tightening budgets, reforecasting, and planning for 18 to 24 months of capital efficiency. Startups anticipating tariff exposure are increasingly prioritizing resilience over rapid scaling, particularly in hardware, cleantech, and cross-border services.

Global Caution Adds to the Drag

The pullback isn’t limited to U.S. investors. International VCs are feeling the drag as well. In Canada, over 76% of startups surveyed said they expect to be affected by U.S. tariffs, and 38% anticipate a direct revenue impact. European VCs are also dialing back activity in U.S.-exposed sectors, and several high-profile firms are advising portfolio companies to delay fundraising until 2026.

For many startups, the game plan now includes optionality - smaller, scrappier rounds, clearer value creation milestones, and contingency plans if the capital environment tightens further. The best founders are adjusting before they’re forced to.

4. Exit Chill: IPOs and M&A Under Pressure

These new tariffs won’t just shake up operations and funding, they also cloud the exit landscape. The volatility unleashed by the new trade policy is starting to freeze momentum in both public listings and strategic acquisitions.

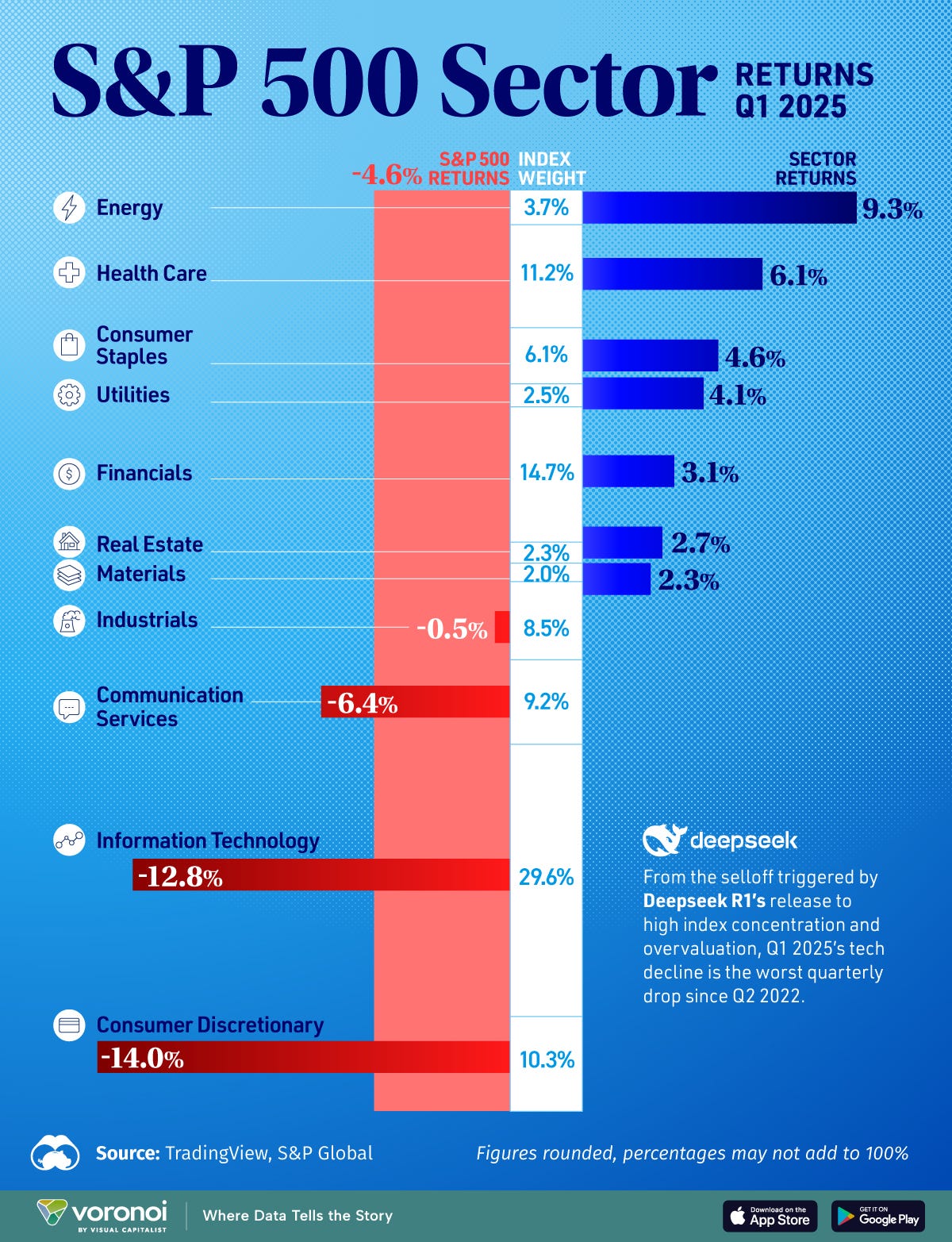

Earlier this year, it looked like the IPO market was beginning to thaw. Klarna, Hinge Health, and several other tech unicorns had quietly filed paperwork, hoping to ride a stabilizing market. But in the 48 hours after Trump’s tariff announcement, the S&P 500 dropped over 4%, and major tech names like Apple, Nvidia, and Amazon lost more than 5% of their market cap. That kind of turbulence makes IPO timing risky. Startups eyeing the public markets are now hitting pause, waiting for volatility to settle before committing to roadshows or pricing.

When exits stall, growth-stage fundraising gets harder. Without fresh IPO comps or recent M&A activity, late-stage investors struggle to benchmark valuations. Deal volume across Series C and D rounds dropped 18% in Q1, and VCs are warning that Q2 could fall even further if public market volatility continues. For capital-intensive startups or those still pre-profit, this creates a tougher story to tell.

M&A Activity Slows as Buyers Get Cautious

Potential acquirers are in wait-and-see mode. Several big tech companies have already frozen exploratory M&A talks as they rework forecasts and assess how tariffs affect their own bottom lines. While there's still over $200 billion in corporate dry powder globally, much of it may sit unused in the near term. Market uncertainty has a chilling effect, even when cash is available.

The exits haven’t disappeared. But the timelines are stretching. Founders who had planned to go public or get acquired in the next 6 to 12 months are now shifting strategy. Many are extending runways, trimming burn, and refocusing on profitability to ride out the storm. In this environment, the startups that can stay flexible will have the advantage.

“Tariffs introduce uncertainty. That uncertainty slows down the economy—not just through cost increases, but through indecision.”

Tomasz Tunguz, Venture Capitalist

5. Strategic Pivots: Tariffs as a Catalyst for Reinvention

For all the disruption tariffs create, they also open new doors. Some startups are treating this moment not as a setback, but as a signal to evolve - whether that means shifting markets, rethinking their supply chains, or launching entirely new products aimed at a changing landscape.

Made in America Gets a Second Wind

With imported goods facing higher costs, U.S.-based manufacturing is getting a fresh look. Startups that already produce domestically now have a pricing edge, and those that don’t are re-evaluating. In sectors like robotics, electric vehicles, and advanced manufacturing, several early-stage companies are accelerating reshoring plans.

Software That Supports the Shift

Startups that help others navigate supply chain chaos are gaining traction. For example, Warehouse Management Systems and AI–powered platforms are becoming essential for optimizing supply chains. Tools that track shipments, optimize inventory, or offer supplier diversification insights are seeing a spike in demand. Enterprise buyers are now budgeting for logistics software that wasn’t even on their radar before. The same trend applies to trade compliance, automation, and procurement analytics.

Defense, Energy, and “Strategic” Sectors Are Heating Up

Some sectors are seeing increased attention thanks to the national focus on self-reliance. Defense tech, cybersecurity, cleantech, and energy infrastructure are drawing more inbound interest from both investors and government partners. U.S. venture capital deployed $3 billion into defense in 2024, marking a record year for the sector, and early 2025 numbers suggest continued strong interest. Energy startups, such as Form Energy, that support domestic grid resilience or battery independence are also being watched closely.

“These tariffs are forcing us to rethink our supply chain entirely. You can’t absorb costs like this and remain competitive.”

Gary Friedman, CEO of RH (Restoration Hardware)

Going Vertical and Owning the Stack

In response to tariff-driven instability, some founders are taking control of more of their supply chain. From in-house manufacturing to direct logistics partnerships, vertical integration is back on the table. This is especially true for mobility and medtech startups, where product quality and timing are tightly coupled with logistics.

6. Efficiency Era: AI, Automation, and the Push for Lean Ops

As tariffs drive up costs and uncertainty stretches across markets, startups and their customers are shifting focus. Growth is still the goal, but now it has to come with discipline. The companies that help others do more with less are quickly moving from “nice to have” to mission-critical.

Rising costs across labor, logistics, and materials are forcing companies to rethink every line item. This pressure is accelerating the adoption of automation, AI, and tools that eliminate inefficiencies. From AI-driven forecasting to workflow automation and low-code platforms, startups that offer measurable ROI are finding strong tailwinds, even as other categories slow down.

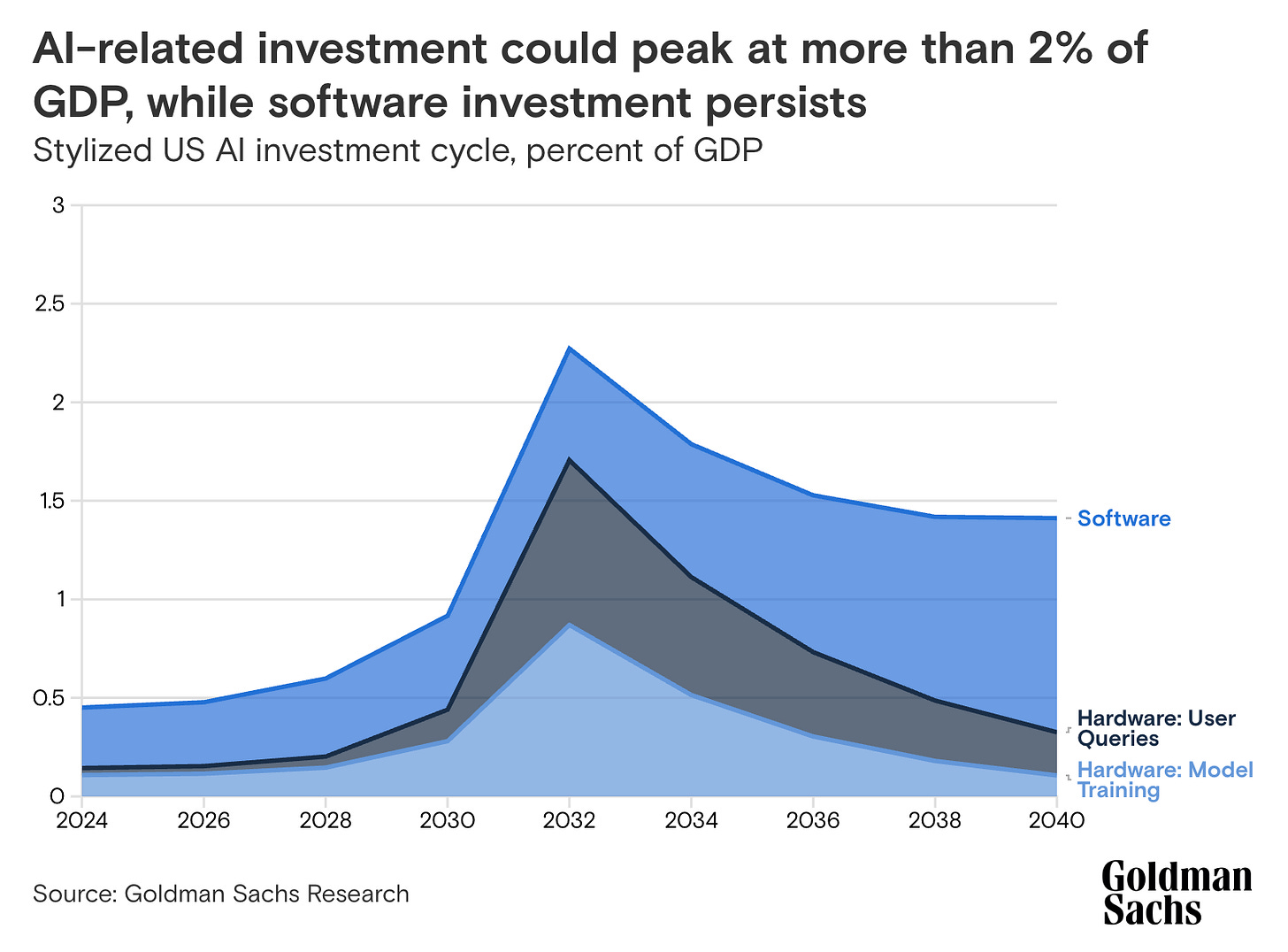

Software Spend Is Resilient, Especially When It Saves Money

Despite volatility, enterprise IT budgets are holding steady in many sectors. U.S. IT spend as a share of GDP is expected to rise over 2% by the 2030s. That long-term thesis hasn’t changed. If anything, cost-cutting environments give SaaS companies that drive efficiency a stronger pitch. Products that reduce headcount needs, simplify compliance, or cut procurement waste are getting fast-track attention.

Lean Ops Is the New Growth Playbook

Efficiency is now a core operating principle, not just a finance team talking point. Startups are reassessing burn, automating internal processes, and prioritizing fewer but more strategic hires. Tools that help with cost control - especially AI-powered platforms - are becoming default parts of the stack. As Lomit Patel explains, leveraging AI and automation is crucial for efficiency.

Whether you're building AI infrastructure, enabling smarter procurement, or offering visibility into operations, this is your moment. The best efficiency-focused startups have the opportunity to not just survive the tariff turbulence, but thrive because of it.

7. Practical Playbook for Founders and Investors

Tariffs have added friction across the startup lifecycle. But they’ve also made some decisions easier to prioritize. This is the moment for operational clarity, sharper financial planning, and strategic flexibility. Founders and investors who take a proactive approach now will be in a better position to adapt as the policy and market environment continue to evolve.

Start With Your Supply Chain

Every founder should know exactly how exposed their business is to tariffs. That means reviewing not just where your components come from, but how dependent you are on single-country suppliers, complex logistics chains, or partners affected by retaliatory policies. Even software companies should understand their cloud infrastructure, hardware dependencies, and customer industry sensitivities.

“We’ve had to delay our U.S. expansion. The tariffs changed our entire cost structure and made our margins disappear overnight.”

European Mobility Startup Founder, via Sifted

Revisit Pricing and Contracts

If input costs are rising, waiting to act can erode margins quickly. Now is the time to revisit your pricing model. Some startups are adjusting how they quote new contracts, while others are working closely with existing customers to explain changes and preserve long-term relationships. On the supplier side, renegotiating minimums or exploring shared-cost models can soften the hit.

Plan for More Runway

The capital environment is still active, just more selective. Founders should consider raising enough to extend runway through 2026, whether that’s via a full round or a clean bridge. Reforecasting based on updated margins and sales cycles will also help sharpen valuation conversations. Investors are looking for discipline and adaptability, not just growth.

Tap into Strategic Tailwinds

Industries like defense, semiconductors, clean energy, and industrial automation are all gaining strategic relevance. Startups operating near these sectors should consider partnerships, enterprise pilots, or public funding opportunities that weren’t on the table a year ago. Domestic manufacturing alliances or government-supported programs may offer new paths to scale.

Rethink Where and How You Grow

Global expansion strategies may need a reset. If a key international market just became more expensive or less stable, it might be time to look closer to home or invest in distributed operations that sidestep tariff friction altogether. Some non-U.S. startups may benefit from looking into U.S. operations for final assembly or compliance reasons. That playbook may make sense in reverse, too.

8. Expert Signals and Founder FAQs

Startup Founder Guide to Navigating Tariffs, Supply Chain Risks, and Fundraising in 2025

As the startup ecosystem reacts to the Trump administration’s new tariff policy, many founders are asking the same urgent questions. Below is an expert-curated FAQ covering supply chain adaptation, venture capital trends, exit strategies, and more—designed to give founders clarity during economic uncertainty.

❓ Which startups are most exposed to U.S. tariff risks?

Startups most at risk from tariff changes include:

Hardware startups importing components (chips, sensors, batteries)

Consumer electronics and mobility companies with global assembly

Direct-to-consumer (DTC) brands relying on overseas production

eCommerce platforms with foreign vendors and logistics partners

Software startups that serve clients in exposed verticals

Even AI and SaaS startups could feel secondary impacts if:

They rely on cloud infrastructure sourced from tariff-affected regions

Their enterprise customers are tightening budgets in response to macro shifts

Keywords: startups affected by tariffs, hardware import costs, global supply chain risk

🔁 How fast can a startup change its supply chain strategy?

Startup supply chain diversification timeline:

3–6 months for early-stage hardware companies using contract manufacturers

6–12 months or more for scaling startups with custom tooling or regulatory compliance needs

Steps founders are taking:

Nearshoring to Mexico, Canada, or Eastern Europe

Domestic assembly for tariff-exempt product categories

Redundant sourcing to prevent bottlenecks

🔎 Pro tip: Use a supply chain audit tool to assess exposure to key countries, parts, or suppliers.

Keywords: startup supply chain pivot, nearshoring strategy, domestic manufacturing for startups

💰 Are VCs still funding startups in 2025?

Yes—venture capital is still active, but more selective.

Post-tariff volatility, investors are prioritizing:

High-efficiency SaaS startups

AI tools with measurable ROI

Defense tech, automation, and energy infrastructure

Capital discipline (runway > 18 months, strong margins, lean teams)

Bridge rounds, SAFE extensions, and milestone-based seed raises are increasingly common.

Founders need to focus on clean data rooms, metrics transparency, and unit economics to stay competitive.

Keywords: VC funding in uncertain markets, startup fundraising during tariffs, investor sentiment 2025

📉 Is now the time to revise our startup’s exit strategy?

Absolutely. Founders should re-evaluate their exit plans.

IPO momentum has stalled amid public market volatility

M&A interest is cooling as acquirers focus on cost control

Deal comps are harder to find, slowing Series C+ fundraising

If you were targeting an IPO or acquisition in 2025, now is the time to:

Extend runway

Cut burn

Prioritize sustainable growth and profitability

📌 Optionality is your best asset. Don’t count on timelines that depend on market timing.

Keywords: startup exit planning 2025, IPO delays, startup M&A slowdown

🔄 What mindset should founders adopt in this new environment?

Adaptability is the new moat.

Founders succeeding in the new tariff economy are:

Running scenario-based forecasts

Pivoting toward high-margin revenue

Embracing lean operations and automation

Aligning with strategic sectors (AI, defense, cleantech, logistics)

Focus on what hasn’t changed:

Strong business fundamentals

Clear customer value

Operational agility

💬 “Startups that move first—not fastest—are winning in this new cycle.”