Finding the right investors at the seed stage is one of the biggest challenges for founders. Cold emails get ignored, warm intros are hard to come by, and most VCs won’t even reply unless your startup is already trending.

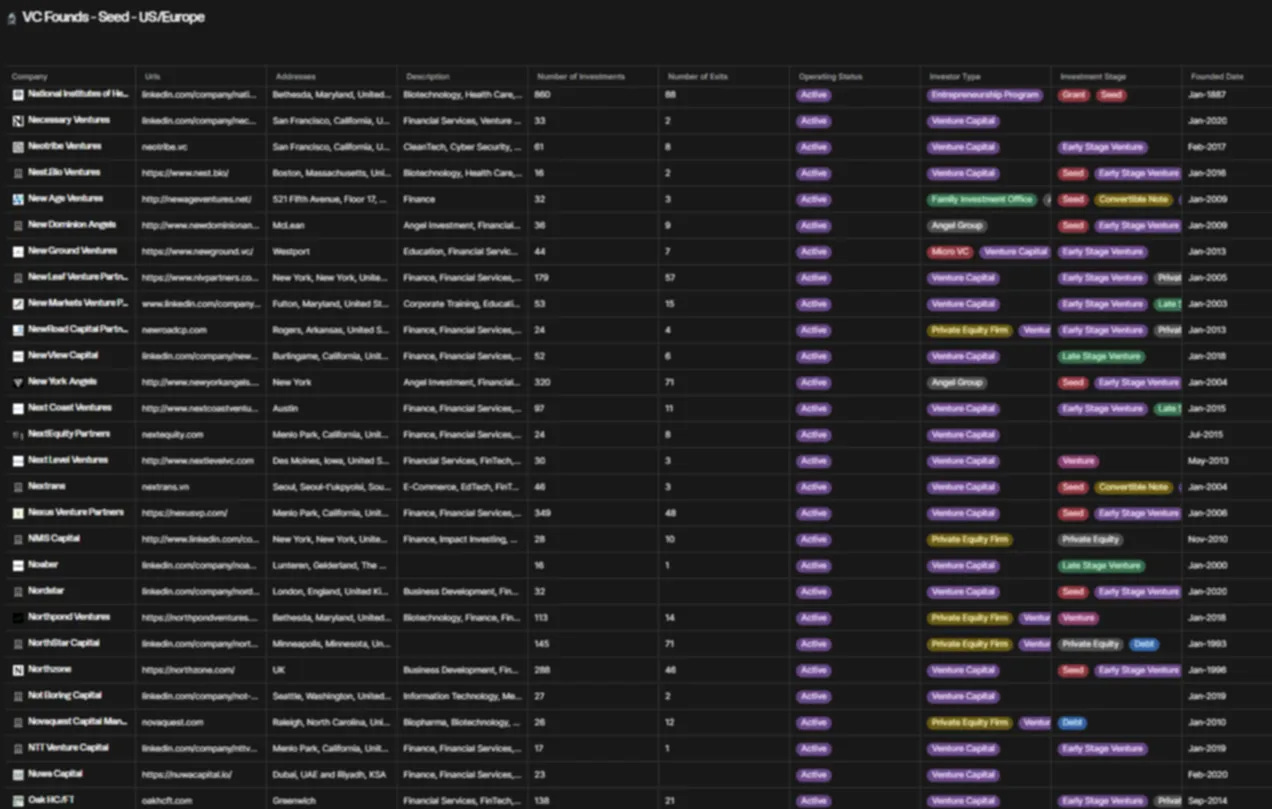

But what if you had direct access to 400+ seed-stage VCs investing in startups across the US and Europe?

This is the most comprehensive list of active Seed VCs—no guesswork, no outdated directories, just a database of real decision-makers who are deploying capital.

Why This List?

Most fundraising guides tell you to "build relationships" and "target the right investors"—but don't tell you who those investors actually are.

This resource changes that.

Here’s what’s inside:

✅ Full VC Firm List – 400+ active funds investing at the Seed stage.

✅ Partner Contacts – Skip junior analysts; reach decision-makers directly.

✅ Investment Focus – Find VCs who actually invest in your industry.

✅ Geographies Covered – Funds backing startups in the US & Europe.

This isn't just another investor list. It's a shortcut to finding the right investors faster, avoiding wasted time, and closing your round.

Why Finding the Right Investors Matters

Fundraising is a numbers game, but not all numbers are equal.

Most founders waste months pitching the wrong investors, only to realize they weren’t a fit from the start. The best way to maximize your chances of success? Pitch investors who are actively funding startups like yours.

🔹 More Efficiency – Stop wasting time on VCs who don't invest in your sector.

🔹 Higher Response Rates – Connect with the right partners from the start.

🔹 Faster Funding Rounds – More warm leads = more term sheets on the table.

How to Use This List to Raise Faster

If you’re raising a pre-seed or seed round, here’s how to turn this list into real investor meetings:

1️⃣ Filter for Investor Fit – Identify VCs that invest in your startup’s sector, geography, and funding stage.

2️⃣ Get Warm Intros – See which portfolio founders you’re connected to and ask for introductions.

3️⃣ Craft the Right Outreach – Avoid generic pitches. Tailor your approach based on each fund’s thesis.

4️⃣ Build Momentum – Investor interest compounds. Run a structured process to create urgency.

With this list, you don’t need to blindly cold email 500 investors. Instead, you’ll have a highly targeted pipeline of VCs who are actually looking for startups like yours.

Who’s This For?

🔹 Early-Stage Founders – Raising your first institutional round? This is your roadmap.

🔹 Bootstrapped Startups – If you're considering VC funding for the first time, this saves months of research.

🔹 Startup Operators & Advisors – Helping founders raise? This is an invaluable resource.

The VC Funding Landscape for Seed Startups

Seed funding rounds in 2024 average $2.7M, with top deals pushing $5M+.

US & Europe lead early-stage investments, with US-based seed VCs deploying $20B+ annually.

AI, SaaS, and Fintech dominate seed-stage investments, but niche sectors are rising.

Ready to Start Fundraising?

📥 Access the full list of 400+ Seed VCs backing startups in the US & Europe below 👇

Keep reading with a 7-day free trial

Subscribe to The VC Corner to keep reading this post and get 7 days of free access to the full post archives.